Forex traders that perfected their trading strategy and are looking to take up a new craft should consider switching over to the stock market. While trading forex certainly has its advantages and main selling points, trading the right stocks at the right time can generate exceptional returns the likes that are just not possible in forex.

According to this day trading guide, forex traders (and anyone with no trading experience) looking to make the switch should follow a three-step approach consisting of: 1) practice with a demo account, 2) don’t trade with money that you can’t afford to lose, and 3) commit to becoming a lifelong student to the stock market.

Stock Trading Offers A Better Schedule

The forex market runs 24 hours a day which makes it difficult for forex traders to fully capitalize on major market moves. While many traders are asleep, reports out of the Bank of Japan or European Central Bank could result in a brief spike in a forex pair that many miss out on because of unfavorable time zones.

By contrast, the stock market is open from 9:30 AM ET to 4:00 PM ET. The pre-market trading session starts at 4:00 AM ET although volume and trading activity doesn’t pick up until the regular session opens.

One in-depth study reported by The Wall Street Journal suggests that the last 30 minutes of a trading session (that is 3:30 PM ET to 4:00 PM ET) can make or break a trader’s day. It notes that around 23% of the entire trading volume in the 3,000 largest stocks takes place after the clock strikes 3:30 PM. By comparison, just 4% of the trading volume takes place during the 30-minute lunch break starting at 12:30 PM.

Of course, trading action can take place throughout the session as unexpected news releases or events can drive stocks higher or lower at any moment's notice. If anything, forex traders can even take advantage of the brief period of a large movement in stocks if they don’t want to give up their primary source of income.

Superior Return Potential

Many stocks in 2020 and 2021 generated returns of 500% or more in a matter of days. Even when accounting for the very high leverage available to forex traders, trading a select group of stocks would have still generated a superior return profile.

Forex traders typically require a higher level of understanding of market dynamics because it requires understanding central bank reports along with monetary and fiscal policy. Forex traders can leverage their knowledge of sifting through information to sort out disruptive noise and focus only on clear catalysts of growth.

The “Reddit revolution” trade of late 2020 and early 2021 is one example of how traders can realize massive gains. Day trading stocks typically involves a trader buying and selling stocks throughout the day so that they end each session with no open positions. Much like in forex trading, this rule is not set in stone and traders can evaluate if a winning one-day trade can last for days, weeks, or even longer.

The same story has been playing out in non-fungible tokens (NFTs) stocks. NFT is a new concept that refers to digital items people collect or trade with each other. Think of unique art or sports cards.

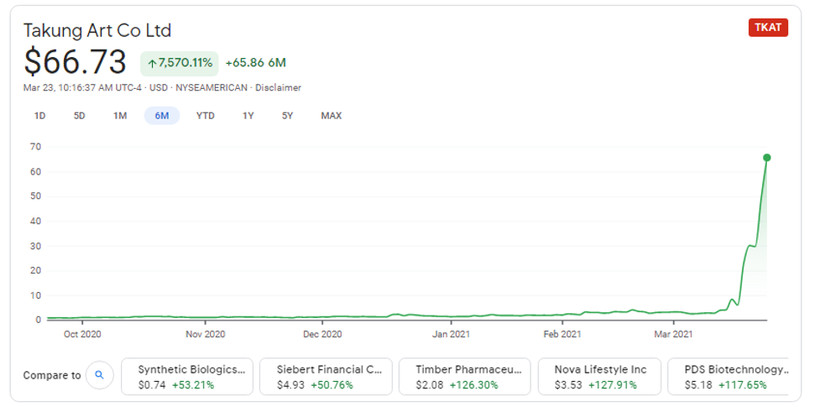

Traders have been gravitating towards companies they believe will enter the space and shares skyrocketed accordingly. Takung Art Co is one example of a stock that has gained more than 250% in one day alone, more than 1,000% in one week, and more than 7,000% in six months.

Reading Forex And Stock Charts Are The Same

Forex traders that are used to trading currencies based on the charts will have a much smoother path when switching to trading stocks. Support and resistance levels on a forex chart look no different than those seen in a stock chart.

The same holds true for perhaps every other technical indicator from MACD, Bollinger bands, moving averages, relative strength index (RSI), and many others.

Risk management strategies that have been refined and perfected for trading forex will require little to no tweaking when trading stocks. Forex traders understand the importance of quickly exiting a trade when it moves against them, especially when there is a clear catalyst to justify the downside move.

The same logic holds true in stocks when a bad earnings report or concerning news release can send a stock crashing down

Conclusion: Get Started With Trading Stocks After Mastering These Three Steps

As previously noted, forex traders shifting over to stocks should follow a simple three-step plan to prepare themselves for the new reality.

First, forex traders should understand that trading stocks will introduce some new challenges but also represent new opportunities. As such, the first few weeks or even a few months should be dedicated exclusively towards practicing on a demo or paper account.

The second step is to figure out how much money you want to deposit into a stock trading account. Requirements vary from broker to broker but some will allow new traders to trade with as little as a few hundred dollars.

A few stockbrokers offer leverage of six to one which is drastically lower compared to forex accounts. So the amount of leverage and ultimate buying power size will need to be considered and evaluated in advance.

Perhaps more important is to deposit only money you can afford (and are willing) to lose.

And finally, the last and perhaps most important step is to study the market, understand the key players, how and why stocks move, and much more. While it is likely that no two traders are completely identical, the one common theme among successful investors is their commitment to continuously study the market to maintain a competitive edge.