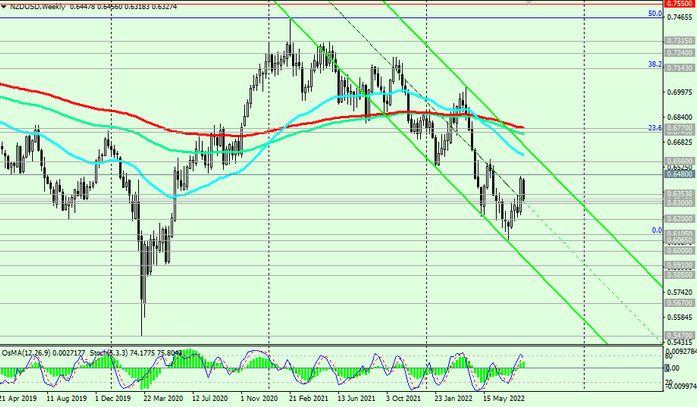

The US dollar is strengthening, as well, against major commodity currencies. In particular, the NZD/USD pair (at the time of publication of this article) is traded in the zone between important short-term levels, support 0.6315 (EMA50 on the daily chart), 0.6300 (EMA200 on the 4-hour chart) and resistance 0.6354 (EMA200 on the 1-hour chart). A breakdown in one direction or another is likely to determine the further direction of the pair's dynamics. In general, the downward dynamics of NZD/USD prevails, while the pair remains in the zone of a long-term bearish market, below the key resistance levels 0.6770 (EMA200 on the weekly chart), 0.6560 (EMA200 on the daily chart).

Taking into account the general upward trend of USD and the downward dynamics of NZD/USD, it is more logical to assume a breakdown of the support levels 0.6315, 0.6300 and further decline deep into the downward channel on the weekly chart. Its lower border passes near the marks of 0.6000, 0.5900, which will become a reference point in case our main scenario comes true.

Only a breakdown of the key resistance level of 0.6770 will bring the pair back into the zone of a long-term bull market. In general, the downward dynamics of NZD/USD prevails, which makes short positions preferable.

Tomorrow (at 02:00 GMT), the decision of the RB of New Zealand on the interest rate will be published, which will cause a sharp increase in volatility during the Asian trading session, primarily in NZD quotes.

It is expected that the RBNZ may raise the interest rate again at this meeting. If the RBNZ signals a tendency to wait and see in its accompanying statement, the New Zealand dollar is likely to be under pressure. However, the market reaction to the RBNZ's decisions regarding the interest rate in the current situation may be completely unpredictable.

Support levels: 0.6315, 0.6300, 0.6200, 0.6105, 0.6100, 0.6000, 0.5900

Resistance levels: 0.6354, 0.6380, 0.6400, 0.6480, 0.6500, 0.6560, 0.6745, 0.6770

Trading recommendations

Sell by-market, Sell Stop 0.6290. Stop Loss 0.6375. Take-Profit 0.6315, 0.6300, 0.6200, 0.6105, 0.6100, 0.6000, 0.5900

Buy Stop 0.6375. Stop Loss 0.6310. Take-Profit 0.6400, 0.6480, 0.6500, 0.6560, 0.6745, 0.6770