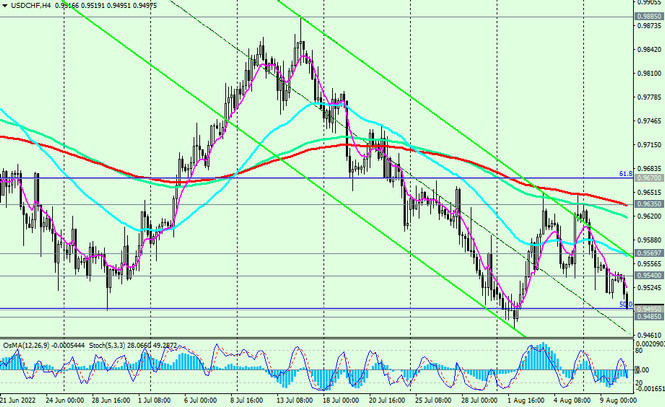

On the eve of the publication (at 12:30 GMT) of the latest US inflation data, would like to pay attention to the USD/CHF pair, which has come close to the key support level 0.9485. From this level, either a good rebound and resumption of the positive dynamics of the pair is possible, or its breakdown with risks of further decline to the next key level 0.9450 (EMA200, EMA144 on the weekly chart), which separates the long-term bullish trend of the pair from the bearish one.

In the main scenario, and after the breakdown of important resistance levels 0.9540 (EMA144 on the daily chart), 0.9570 (EMA200 on the 1-hour chart), USD/CHF will head towards the resistance levels 0.9635 (EMA200 on the 4-hour chart, EMA50 on the daily chart) , 0.9670 (Fibonacci 61.8% of the upward correction to the down wave that began in April 2019 near 1.0235). Their breakdown, in turn, will finally complete the downward correction of USD/CHF and send the pair towards recent multi-month highs near 1.0000, 1.0060.

Support levels: 0.9495, 0.9485, 0.9450, 0.9415

Resistance levels: 0.9540, 0.9570, 0.9635, 0.9670

Trading recommendations

Sell Stop 0.9465. Stop Loss 0.9550. Take Profit 0.9450, 0.9415, 0.9400, 0.9325

Buy Stop 0.9550. Stop Loss 0.9465. Take-Profit 0.9570, 0.9635, 0.9670, 0.9900, 0.9970, 1.0000, 1.0060