As we noted above, today the market and the dollar will "swing" again at 12:30, when the data on personal income / expenses of Americans will be published. However, at the same time (at 12:30 GMT) Statistics Canada will publish a report with data on Canada's gross domestic product for May. Canadian GDP is expected to fall (by -0.2%) for the first time since the beginning of this year. This is already the first disturbing "bell" for CAD after yesterday's publication of negative US GDP.

If today's Canadian GDP report turns out to be disappointing, then the Bank of Canada, like the Fed, will face the risks of stagflation (zero growth or decline in GDP against the backdrop of high inflation).

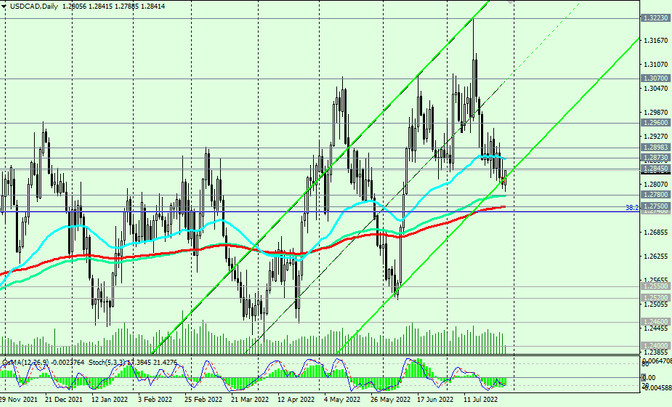

In the meantime, USD/CAD is in the stage of a downward correction within the general uptrend, above the key support levels 1.2780 (EMA144 on the daily chart), 1.2750 (EMA200 on the daily chart).

Today's publication at 12:30 (GMT) may become a driver of growth, if the data for the US turns out to be positive, and for Canada (GDP for May) - negative.

Breakdown of short-term resistance levels 1.2873 (EMA200 on the 1-hour chart), 1.2898 (EMA200 on the 4-hour chart) will be a confirmation signal for resuming long positions in USD/CAD.

In an alternative scenario, and after the breakdown of the support levels 1.2750, 1.2740 (the Fibonacci level 38.2% of the downward correction in the wave of USD/CAD growth from 0.9700 to 1.4600), USD/CAD will continue to decline, moving into the long-term bear market zone.

Support levels: 1.2845, 1.2800, 1.2780, 1.2750, 1.2700, 1.2550, 1.2520

Resistance levels: 1.2873, 1.2898, 1.2900, 1.2960, 1.3000, 1.3070, 1.3100, 1.3223

Trading recommendations

Sell Stop 1.2770. Stop Loss 1.2860. Take Profit 1.2750, 1.2700, 1.2550, 1.2520

Buy Stop 1.2860. Stop Loss 1.2770. Take-Profit 1.2873, 1.2898, 1.2900, 1.2960, 1.3000, 1.3070, 1.3100, 1.3223