The dollar weakened sharply after yesterday's decision by the Fed to raise interest rates by 0.75%. Moreover, in their accompanying statement, Fed officials said it "would be appropriate" to raise the rate further.

But something went wrong - the dollar fell shortly after the start of the Fed press conference. What has alarmed investors? Indeed, strong macro data continue to come from the United States, and "the labor market is characterized by an extremely strong excess of demand for labor over its supply."

And from the news for today, market participants will pay attention to the publication at 12:30 (GMT) of weekly data from the US labor market and, as we noted above, data on US GDP for the 2nd quarter, which may confirm the gloomy forecasts of some economists about the prospects American economy. If the expected data really turns out to be frankly weak, then the pressure on the dollar will increase, and the XAU/USD pair, at the same time, will accelerate growth.

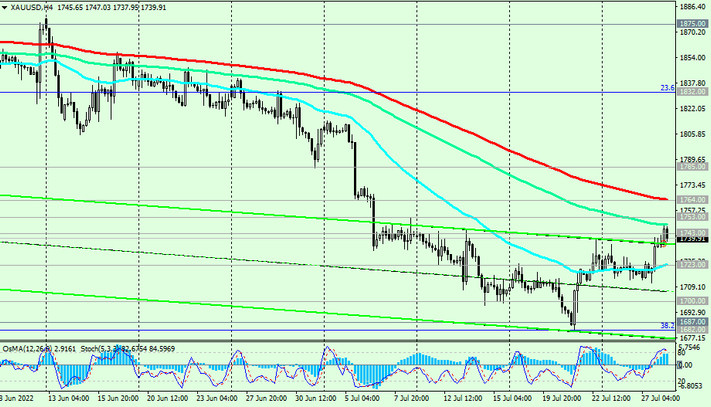

Then, after the breakdown of the resistance level 1785.00 (EMA50 on the daily chart), the road will be open to the key resistance level 1832.00 (EMA200, EMA144 on the daily chart, EMA50 on the weekly chart and the Fibonacci level 23.6% of the correction to the growth wave from December 2015 and 1050.00 mark).

Its breakdown, in turn, will finally return XAU/USD to the zone of a long-term bull market.

In an alternative scenario, a breakdown of the long-term support level 1668.00 (EMA50 on the monthly chart) may “push” XAU/USD out of the long-term bull market zone, sending it towards the support levels 1275.00, 1050.00, the break of which will complete this process.

The first signal for the realization of this alternative scenario is the breakdown of the local support level 1712.00.

Support levels: 1723.00, 1712.00, 1700.00, 1687.00, 1682.00, 1668.00

Resistance levels: 1743.00, 1753.00, 1764.00, 1785.00, 1800.00, 1832.00, 1875.00

Trading recommendations

Sell Stop 1732.00. Stop Loss 1754.00. Take-Profit 1723.00, 1712.00, 1700.00, 1687.00, 1682.00, 1668.00

Buy Stop 1754.00. Stop Loss 1732.00. Take-Profit 1764.00, 1785.00, 1800.00, 1832.00, 1875.00