After yesterday's strong fall, today the dollar resumed growth at the beginning of the European trading session.

Thus, at the time of publication of this article, the DXY dollar index is near 106.73, although yesterday the DXY dollar index closed at 106.33, and during today's Asian trading session, DXY futures fell to an intra-week low of 105.93.

But what is the reason for such unusual dynamics of the dollar? After all, yesterday the Fed once again raised the interest rate by 0.75%, and its head, Jerome Powell, said that "another unusually large rate increase may be appropriate at the next meeting," confirming the Fed's tough intentions. Speaking at a press conference following yesterday's meeting, Powell also said that "the labor market is characterized by an extremely strong excess of demand for labor over its supply," and "wage growth is occurring at a rapid pace."

And yet, the dollar fell shortly after the start of the Fed's press conference. Something alarmed investors. Perhaps they focused their attention on the disturbing tones of other accompanying statements by Fed officials. "We expect a period of economic growth below the trend," and the whole "process" will be accompanied by a period of "lower economic growth, weakening the labor market," - said Powell. Indeed, in the 1st quarter, US GDP fell by -1.6%. Apart from the fall in GDP in the 1st half of 2020, when the entire global economy was affected by the coronavirus pandemic, the decline in the 1st quarter of 2022 was the first since 2015.

Today at 12:30 (GMT), the most important indicator characterizing the state of the US economy - GDP data for the 2nd quarter - will be published. A modest increase of +0.4% is expected. However, there is also a negative forecast for a further fall in GDP, which will already speak of a recession in the US economy. And, although the US government is so afraid of this word, it is possible that this scenario has an extremely high probability of being realized.

If so, tightening monetary policy by raising interest rates in a recession would be extremely devastating for an economy.

And if the threat of recession is followed by the threat of stagflation (zero growth or falling GDP amid high inflation), this is an even worse scenario, threatening the economy with a downward spiral with millions of unemployed citizens and the impoverishment of the majority of the country's population.

The U.S. midterm congressional elections will be held in the fall (November 8), which could be critical for Democrats and for the 2024 presidential election. It is possible that soon, and even before the end of this year, the Fed will again have to move from tightening to easing its monetary policy.

That is why the dollar fell sharply yesterday, and today continued to fall during the Asian trading session.

Also at 12:30 (GMT) will be published weekly report from the US Department of Labor with data on the number of applications for unemployment. If everything turns out to be bad here, then the fall of the dollar, which stopped at the beginning of today's European session, may resume with renewed vigor.

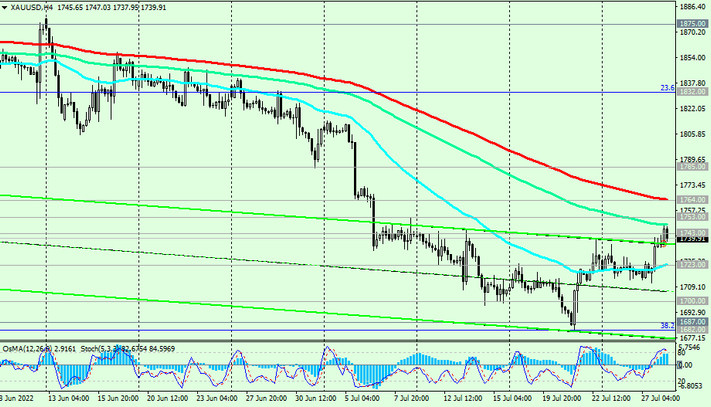

In this situation, investors again turned their attention to gold. The XAU/USD pair is growing again today after yesterday's surge “to the north”.

The breakdown of the resistance levels of 1743.00, 1753.00, 1764.00 may again create preconditions for XAU/USD to enter the long-term bull market zone. But gold quotes are extremely sensitive to changes in the Fed's monetary policy: when interest rates rise, it usually falls in price!