The DXY dollar index rose today during the Asian trading session. Thus, DXY futures reached an intraday high of 104.72 today, rising above a 3-day high. The dollar is strengthening today, especially against major commodity currencies such as the Canadian, Australian, New Zealand dollars, amid a cautious attitude of investors to purchases of risky assets and falling commodity prices.

The price of oil futures dropped sharply today. Thus, August futures for Brent crude on London's ICE Futures exchange fell more than 4% today against yesterday's closing price, falling below $109.00 per barrel. The spot price of Brent oil returned to the levels of 5 weeks ago, risking further decline to the psychologically significant level of $100.00 per barrel.

Fears are growing in the market that the rapid tightening of monetary policy by the world's largest central banks, which so far cannot stop accelerating inflation, will lead to recession and stagflation (this is when economic growth slows down or stops altogether, while inflation continues to grow) in the global economy. These fears lead to increased demand for a safe dollar, which, in turn, puts pressure on stock markets and commodity currencies.

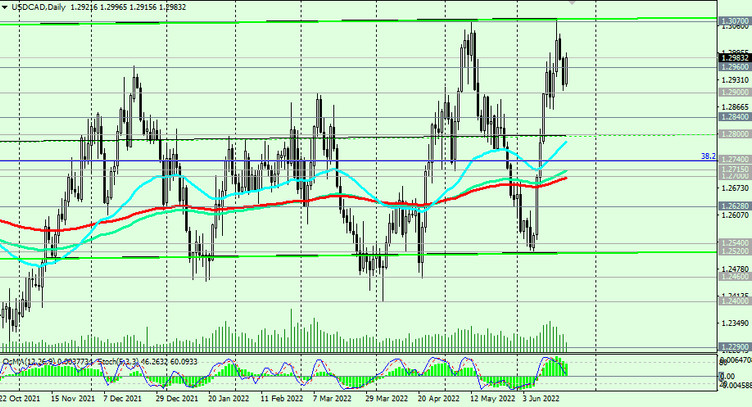

In particular, the USD/CAD pair resumed growth today after falling in the previous 2 days and returned to the closing price levels last Monday.

As you know, CAD quotes are very sensitive to the dynamics of oil prices, since Canada is a major supplier of oil to the world market, primarily to the United States.

Market participants are waiting for the speech (today and tomorrow) of Fed Chairman Jerome Powell in Congress.

During his speech, Jerome Powell will assess the current situation in the US economy and point out the future plans of the Fed's monetary policy. Any signals from his side regarding changes in the plans of the Fed's monetary policy will cause a sharp increase in volatility in USD quotes. The tough rhetoric of his speech regarding the containment of inflation and the Fed's policy plans will cause the USD to strengthen. Powell's performance starts at 13:30 today and tomorrow at 14:00 (GMT).

As for the USD/CAD pair, today the volatility in its quotes will increase at 12:30 (GMT), when the consumer price indices in Canada are published. Core Consumer Price Index (Core CPI) from the Bank of Canada reflects the dynamics of retail prices of the corresponding basket of goods and services (excluding fruits, vegetables, gasoline, fuel oil, natural gas, mortgage interest, intercity transportation and tobacco products). The inflation target for the Bank of Canada is in the range of 1%-3%. The rising CPI is a harbinger of a rate hike and positive for the CAD. The core consumer price index increased in April 2022 by +0.7% (+5.7% in annual terms), in March 2022 by +1.0% (+5.5% in annual terms), in February by +0.8% (+4.8% in annual terms), in January by +0.8% (+4.3% in annual terms). If the expected data turns out to be worse than the previous values, then this will negatively affect the CAD. Data better than previous values will, probably, strengthen the Canadian dollar. Forecast for May: +0.3% (+5.9% in annual terms).