The DXY dollar index strengthened at the beginning of today's European session, continuing its growth since last June and coming close to the next "round" mark of 102.00.

The growth of DXY continues, mainly due to the fall against the dollar, the euro and the pound, the share of which in the DXY index is approximately 58% and 12%, respectively.

The dollar is also rising against other European currencies, in particular the Swiss franc, which is also included in the basket of 6 currencies that make up the dollar index. Its stake in DXY is approximately 4%. Despite the fact that the franc enjoys the status of a defensive asset and is strengthening against other major currencies, it continues to weaken against the US dollar.

Market participants are waiting for the start of the May meeting of the Fed. No one doubts that at the May 3-4 meeting, the Fed will raise interest rates by 50 basis points at once. Moreover, some market participants and economists are making bolder forecasts that the interest rate will be increased by 0.75% or even 1.00%.

As you know, in March, annual inflation in the US hit a record high of 8.5%, and Fed chief Jerome Powell last week confirmed that interest rates would be raised by half a percentage point in May.

Many economists now fear that a tighter Fed tightening cycle could send the economy into recession, and consumers are already worried about the state of the economy. Yesterday, Cleveland Federal Reserve Bank President Loretta Mester said she did not want to "shock the economy" by raising the key rate by 75 basis points at a meeting in May. "I prefer a more methodical approach than a 75 basis point increase. I don't think it's necessary as part of our policy," Mester said in an interview with the media.

Today, market participants will pay attention to the publication at 12:30 (GMT) of the Census Bureau report with data on orders for durable goods and capital goods. This indicator reflects the value of orders received by producers of durable goods and capital goods (capital goods are durable goods used to produce durable goods and services) involving large investments. Forecast for March: +1.0% (durable goods orders), +0.5% (capital goods orders excluding defense and aviation) after falling -2.1% and -0.2% in February, respectively. This is weakly positive data for the dollar. But the data better than the forecast will provide the dollar with more significant support.

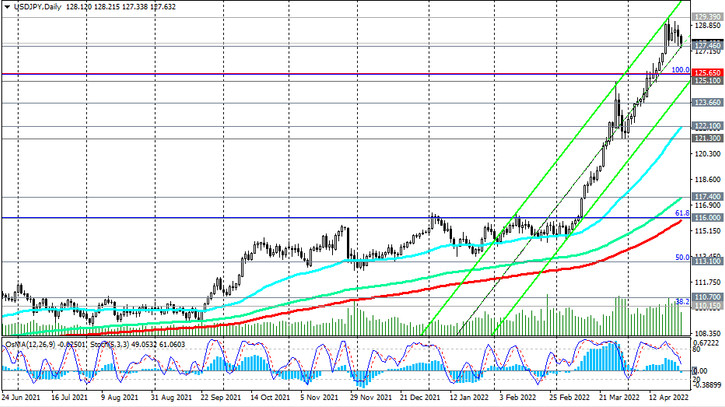

It is worth noting, however, that the dollar has suspended its growth against the Japanese yen.

The USD/JPY uptrend stalled last week when the pair updated multi-year highs near the 129.40 mark. At the meeting on Thursday, the Bank of Japan is likely to keep the rate at the same level of -0.10%, despite the acceleration of inflation and rising energy prices (Japan is a net importer of energy resources). A joint report released the day before by the Ministry of Health, Labor and Welfare, as well as the Bureau of Statistics of Japan for March, indicated a decrease in unemployment in the country to a two-year low of 2.6%, and the index of coincident indicators rose to 96.8 points (from 96.3 in January) , which turned out to be better than the negative forecast for a decline to 95.5 points. However, this data is still not enough for the Bank of Japan to move to tighten its monetary policy, focusing on maintaining the fragile economic recovery after the coronavirus pandemic.

Thus, the accelerating divergence of the curves reflecting the direction of the monetary policies of the Fed and the Bank of Japan will continue to encourage dollar purchases at the expense of the cheap yen.

*) Bank of Japan rate decision will be published on Thursday at 03:00 (GMT).