Despite the slightly discharged domestic political situation in Europe after Macron's re-election in France for a 2nd term, the euro continues to decline against the dollar at the beginning of today's trading day, reaching a 2-year low near the 1.0710 mark.

The euro also fell against the defensive franc and yen. However, there is a conflicting picture in some cross pairs with the euro. If the euro falls against the Canadian dollar, then it grows again against the British pound, continuing the upward correction formed at the beginning of last week. Thus, EUR/GBP reached 0.8414 last Friday, and today the pair continues to grow. At the time of writing this article, EUR/GBP is traded near 0.8430 mark moving towards the key resistance level 0.8450.

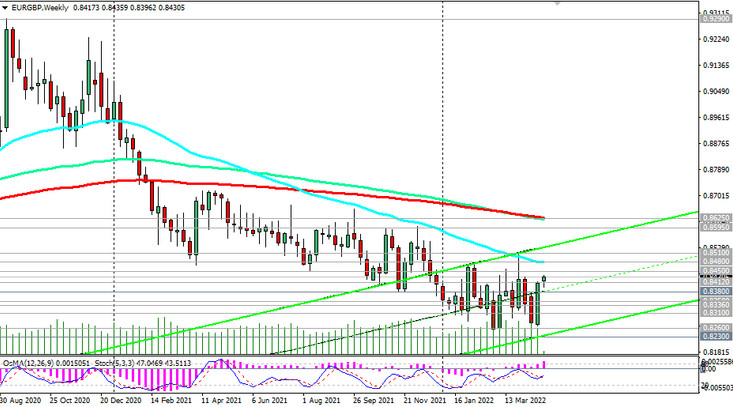

Both the euro and the pound are currently weak against the dollar. Considering the general downtrend of EUR/GBP, which formed at the beginning of 2021, the current growth of the pair should be considered as a correction for now. It may still continue to the resistance levels of 0.8450, 0.8480. However, trends don't break that quickly. Therefore, it is logical to place additional pending sell orders near the above resistance levels.

The euro may strengthen if the ECB raises rates more significantly than markets expect, economists say, for example, if the key interest rate of the ECB exceeds the level of 1.5%, which is already taken into account by markets as a maximum for the next 1.5-2 years.

Otherwise, the euro will remain under pressure. Events in Ukraine could be a stagflationary shock for Europe, slowing economic growth while pushing up prices. This, according to many economists, makes it harder for the ECB to roll back stimulus measures to regain control of inflation without undermining the economic recovery.

In the meantime, EUR/GBP is growing, including due to the continuing weakening of the pound. A number of weak macro statistics, received from the UK last week, continues to overshadow the outlook for the British currency.

Thus, weak reports on retail sales (in March, retail sales fell by 1.4%, while economists expected a fall of 0.2%) and on the activity of purchasing managers (PMI from Markit Economics), indicating a fall in the composite PMI index in the UK in April to a 3-month low of 57.6 from 60.9 in March (forecast was 58.5), reduced traders' expectations regarding the strengthening of the pound.

GfK's previously published consumer confidence indicator, which dropped to its lowest level since 2008-2009 -38 in April (after dropping to -31 in March), only adds to the current negative picture for the pound.

Weak macro statistics from the UK clouded the enthusiasm of investors about the prospects for further tightening of monetary policy by the Bank of England.

This week the publication of macro statistics on the UK is expected to be a bit. Therefore, in the dynamics of EUR / GBP, one should focus on the news that will come from the US and the Eurozone, where disputes continue regarding the import of oil and gas from Russia. Although the EU plans to further reduce energy dependence on Russian resources, this, in turn, will lead to a further increase in energy prices, also pushing up the already high inflation.

On Tuesday (at 12:30 GMT) the report of the US Census Bureau on orders for durable goods implying large investments will be released, on Thursday (at 12:30 GMT) - data on US GDP for the 1st quarter, and on Friday - data on GDP of Germany (at 06:00), the Eurozone and consumer inflation indices of the Eurozone for the 1st quarter of 2022 (at 09:00).

Support levels: 0.8412, 0.8400, 0.8380, 0.8350, 0.8336, 0.8310, 0.8260, 0.8230, 0.8200, 0.8145

Resistance levels: 0.8450, 0.8480, 0.8510

Trading Recommendations

Sell limit 0.8440, 0.8450, 0.8470. Stop Loss 0.8520.

Sell Stop 0.8410. Stop Loss 0.8435.

Take Profit 0.8400, 0.8380, 0.8350, 0.8336, 0.8310, 0.8260, 0.8230, 0.8200, 0.8145

*) a growth into the zone above the resistance level 0.8625 (EMA200 on the weekly chart) will mean the break of the long-term bearish trend of EUR/GBP.