Speaking to the National Business Economics Association on Monday, Fed chief Jerome Powell said a 0.5 percentage point rate hike could be possible at every central bank meeting if bank officials believe such moves are warranted to bring down inflation.

“We will take the necessary steps to ensure that price stability is restored”, Powell said. He was backed by Atlanta Fed chief Rafael Bostic, saying the central bank will need to raise interest rates more aggressively this year to slow inflation. “Frankly, getting high inflation under control is my main concern in 2022”, Bostic said on Monday, noting that he now forecasts six rate hikes this year. He previously expected rates to be raised three times in 2022.

It is worth noting that the Fed has not raised the key rate by 0.50% since May 2000, which indicates its extreme concern about accelerating inflation in the US.

The military conflict in Ukraine against the backdrop of Western sanctions against Russia may lead to an even greater increase in energy and food prices around the world, which will cause increased inflationary pressure on the global economy. At the same time, the median level of consumer inflation expectations in the US for the year ahead was 6.0% in February, against 5.8% in January. And as we remember, from a recent report by the US Department of Labor, the annual consumer price index (CPI) reached a 40-year high of 7.8% in February.

After Powell's speech, the yield on 10-year US Treasury bonds rose sharply yesterday and continued to rise today, reaching 2.328%, a new almost 3-year high. Note that prior to the Fed's decision to raise the interest rate by 0.25% at the meeting on March 15-16, the yield on 10-year bonds was 2.190%.

The dollar also strengthened on Monday and during today's Asian trading session, with the DXY dollar index hitting a 4-day high of 98.96 today.

Powell's next speech is scheduled for Wednesday (at 12:00 GMT), and market participants will be waiting for new signals from him regarding the Fed's monetary policy outlook. Probably, he will once again announce the readiness of the central bank's leadership to continue the policy of raising the interest rate, which may have a positive impact on the dollar.

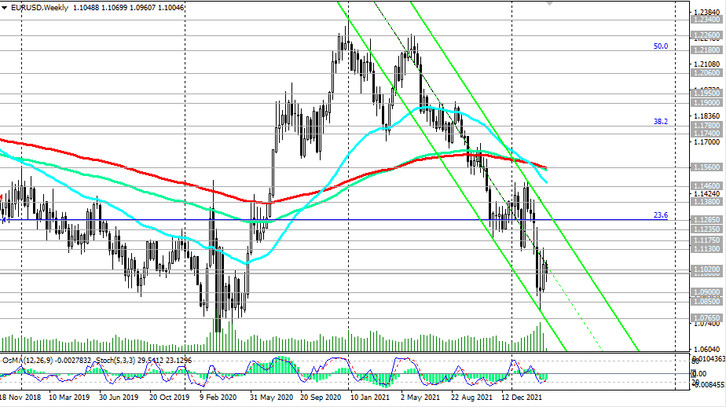

Meanwhile, the dollar's main competitor in the currency market euro is declining, including in the EUR/USD pair.

During yesterday's speech at a financial conference, ECB President Christine Lagarde acknowledged that the prospects for monetary policy of the European Central Bank and the Fed diverge significantly. "Our two economies are in different phases of the business cycle", Lagarde said. In her opinion, this was even before the start of Russia's special military operation in Ukraine, and "for geographical reasons, Europe is much more prone to war than the United States". She is scheduled to speak again today at 13:15 (GMT) and is likely to reiterate her key messages that risks to the European economy are skewed to the downside.

According to many economists, the European economy is likely to face a recession, while the world is experiencing high energy and food prices, and the situation in this regard will only get worse. Moreover, the EU is preparing to consider the introduction of a new, fifth package of sanctions against the Russian economy. Among other things, the new measures may include the imposition of a moratorium on the import of Russian oil and gas. Although the position of European states on this matter is different, and Germany is very strongly opposed to this, the introduction of new restrictive measures against Russia will also negatively affect the European economy, which, according to many economists, is sliding into stagflation (this is a situation where an economic recession and high unemployment rate is accompanied by rising inflation).

Thus, the EUR/USD pair is likely to see further decline. After the retest of the support level 1.1000 and its confirmed breakout, the targets are 1.0900, 1.0800.