The results of the Fed meeting, which ended last Wednesday, provoked a weakening of the dollar.

As you know, the Fed raised the interest rate by 0.25% (FOMC members voted “yes” by an absolute majority) and announced plans to raise the interest rate another 6 times this year, as well as start reducing its balance sheet, possibly at the next meeting in the beginning of May.

The dollar fell sharply after the publication of the Fed's decision on rates and continued to decline the next day. As a result, the DXY dollar index lost more than 1% over the past two days, falling to 97.98. Today the dollar is strengthening again, and the DXY dollar index is growing. At the time of publication of this article, it is close to 98.21. Traders fix short dollar positions at the end of the week, while most economists predict further dollar growth. Apparently, Fed officials are much more concerned about accelerating inflation than the risk of an economic slowdown in 2022.

According to data released last week, inflation in the United States reached a new high in 40 years: the consumer price index in February rose from 0.6% to 0.8%, and in annual terms - from 7.5% to 7.9%.

"The economy is extremely strong, the demand for labor is extremely high". With these words, the head of the Fed, Jerome Powell, began his press conference after the meeting of the central bank on Wednesday. But he also noted the high rate of inflation, which "creates considerable hardship, especially for those who find it hardest to afford to buy what they need at higher prices". In addition, he noted that the fighting in Ukraine could harm the US economy, causing volatility in financial markets and worsening foreign trade conditions for the US.

At the same time, Fed officials raised their inflation forecast in 2022 more than economists expected. The Fed expects inflation to rise to 4.3% this year and Core CPI to 4.1%. According to Fed officials, the decline in inflation will begin only next year, but even then core inflation is expected to be around 2.6%, while the Fed's target is 2%. Despite the decline, these are still high numbers, given the 7 rate hikes this year, as planned by the Fed.

Meanwhile, despite the fact that the DXY dollar index is growing, the main commodity currencies are in no hurry to decline against the dollar itself.

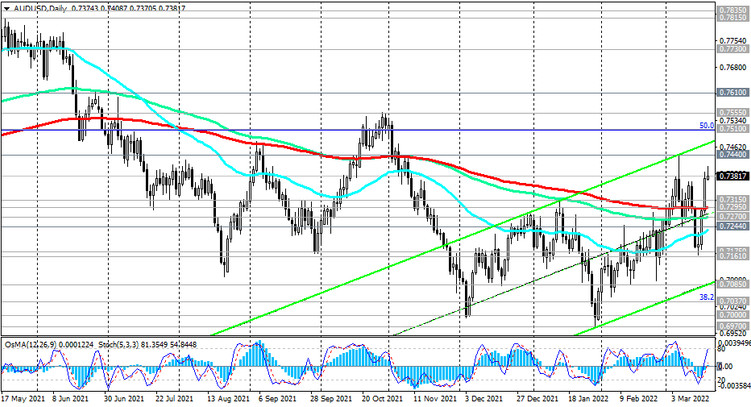

Thus, the AUD/USD pair is traded at the time of publication of this article near the 0.7383 mark, remaining in the area of yesterday's and intra-week highs. The Australian dollar is supported by very positive data published on Thursday morning from the Australian labor market.

Unemployment in Australia fell to 4.0% in February (versus 4.2% in January and 4.1% forecast), the lowest level since August 2008, the Australian Bureau of Statistics said. The employment rate increased by 77.4 thousand instead of the expected 37.0 thousand. The published data indicate that the economy is approaching full employment, fueling talks about the possibility of an early increase in the RBA interest rate. The Central Bank of Australia keeps them at a minimum level of 0.1%. If it goes to raise the interest rate, then it will do it for the first time since 2010.

RBA Governor Philip Lowe continues to insist on the need to be patient as wage growth remains weak and inflation has yet to settle into its 2%-3% target range. In his opinion, raising rates this year is "possible" against the backdrop of rising inflation and accelerating employment growth, but this does not mean that it is necessary.

The next RBA meeting will take place early next month. If the global stock and commodity markets do not experience another collapse, then, most likely, before the RBA meeting (March 5), the AUD/USD pair will remain trading in the bull market zone, above the key support levels 0.7315, 0.7295 (see Technical analysis and trading recommendations). If the US dollar weakens, the pair AUD/USD may try to re-test the local resistance level 0.7440.