Meanwhile, despite the observed fall in prices for oil and other commodities, quotations of commodity currencies such as the Canadian, Australian and New Zealand dollars are growing.

The NZD/USD pair is growing today for the second day in a row, primarily on the weakening of the USD.

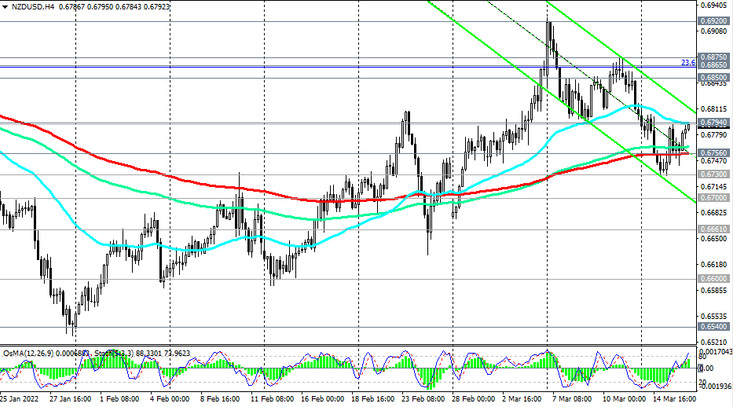

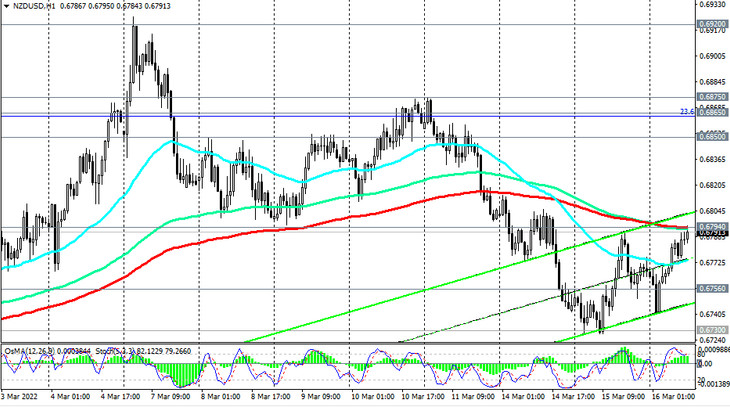

At the time of publication of this article, the pair is traded near the important short-term resistance level 0.6794 (EMA200 on the 1-hour chart). Its breakdown will open the way for further corrective growth towards the key resistance levels 0.6850 (EMA200 on the weekly chart), 0.6865 (Fibonacci 23.6% of the correction in the global wave of the pair's decline from the level 0.8820), 0.6875 (EMA200 on the daily chart).

Below these resistance levels, the NZD/USD remains in the bear market zone. But the breakdown of these levels may provoke further strengthening of the NZD/USD with the prospect of returning into the bull market zone. The breakdown of the local resistance level 0.6920 will be a confirmation signal for the implementation of this scenario.

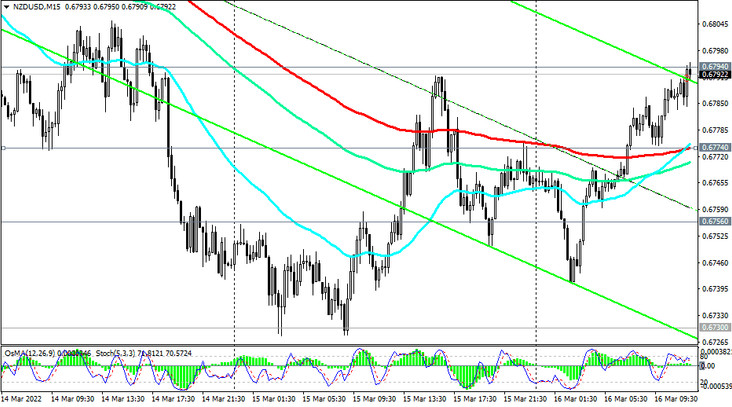

In the main scenario, we expect a rebound from the resistance level 0.6794 and the resumption of the downward trend. The first signal for the resumption of sales will be a breakdown of the short-term support level 0.6774 (EMA200 on the 15-minute chart), and a breakdown of the support level 0.6756 (EMA200 on the 4-hour chart and EMA50 on the daily chart) - confirming.

Let's also pay attention to the fact that the volatility in the NZD quotes and the USD/NZD pair, respectively, may increase again at the end of today's trading day, when at 21:45 (GMT) the report of the Bureau of Statistics of New Zealand with data on the country's GDP for 4 th quarter. GDP is expected to grow by +3.2% in the 4th quarter of 2021 (previous values -3.7%, +2.8%, +1.6%, -1.0%, +13.9% , -11%, -1.2%, +0.1%) and +3.3% in annual terms. Previous values in annual terms: -0.3% +17.9%, +2.9%, -0.8%, +0.2%, -11.3%, 0%, +1.7%. The data so far remain conflicting, although they indicate a continued gradual recovery of the New Zealand economy after its fall in the first half of 2020. The data worse than the forecast and especially the previous values will have a negative impact on the NZD quotes.

Support levels: 0.6774, 0.6756, 0.6730, 0.6700, 0.6661, 0.6600, 0.6540, 0.6500

Resistance levels: 0.6794, 0.6850, 0.6865, 0.6875, 0.6920, 0.7100, 0.7170, 0.7240, 0.7315, 0.7380, 0.7430, 0.7550, 0.7600

Trading recommendations

NZD/USD: Sell Stop 0.6770. Stop Loss 0.6815. Take-Profit 0.6756, 0.6730, 0.6700, 0.6661, 0.6600, 0.6540, 0.6500, 0.6260

Buy Stop 0.6815. Stop Loss 0.6770. Take-Profit 0.6850, 0.6865, 0.6875, 0.6920, 0.7100, 0.7170, 0.7240, 0.7315, 0.7380, 0.7430, 0.7550, 0.7600