An official Labor Department report released last Friday showed that the number of US non-farm payrolls rose by 467,000 in January, while the unemployment rate, although rising to 4.0%, remained at pandemic lows. The figures were stronger than expected, given the spread of the omicron strain of coronavirus and labor shortages.

Nevertheless, despite the strong report of the US Department of Labor, the dollar was unable to fully benefit from the results of this publication. Last week, the DXY dollar index even declined, shedding 1.8%, returning to the levels of July 2020 (at the time of publication of this article, DXY futures are traded near the 95.60 mark).

And yet, economists believe that the decline in the dollar will not be long. From the results of the January meeting of the Fed, it follows that the US central bank will overtake other major world central banks in the process of tightening monetary policy, and the divergence of the curves reflecting the dynamics of monetary policies will increase over time. And this is one of the most important factors in favor of further strengthening of the USD, if, of course, the Fed manages to quickly cope with rising inflation as a result of these actions.

Last month, when the Fed's January meeting ended, Fed chief Powell said "the economy is in very good shape, inflationary pressures are high, so it would be prudent to consider shifting (plans) to curtail asset purchases for a few months earlier".

At the same time, if the Fed falls behind in the process of curbing accelerating inflation, the dollar may again come under pressure. The Fed may find itself in the dilemma of containing high inflation on the one hand, and the task of not harming the economic recovery due to higher interest rates on the other. If the Fed fails to contain rising inflation, it will make it harder to keep the balance between economic growth and the monetary tightening cycle, and this, in turn, could hurt the dollar.

In this regard, and from this point of view, it is worth paying attention to the dynamics of gold prices. It, as you know, does not bring investment income, but is a popular defensive asset, especially in the face of rising inflation.

At the same time, gold quotes are extremely sensitive to changes in the monetary policy of the world's leading central banks, especially the Fed. When it tightens, the quotes of the national currency (under normal conditions), as a rule, grow, while the price of gold falls.

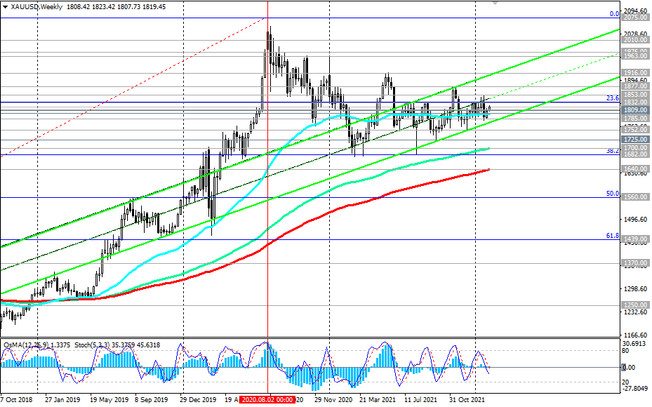

However, as we can see from the long-term charts of gold quotes, its price is not going to fall.

As noted recently in the World Gold Council (WGC), the dynamics of gold prices is not entirely clear against the background of multidirectional factors: fears about high inflation and anticipation of an increase in interest rates, primarily in the Fed. Thus, according to WGC analysts, the dynamics of gold prices will depend on "whether investors' concerns about inflation will intensify and whether interest rates will rise faster than expected".

The latest World Gold Council Demand Trends Report showed that annual demand has reversed many of the losses caused by COVID since 2020. Demand for gold bars and coins rose 31% to an 8-year high of 1,180 tons as retail investors sought shelter amid rising inflation and ongoing economic uncertainty caused by the coronavirus pandemic.

The WGC expects that in 2022 the dynamics of gold will be similar to its dynamics in 2021. Higher global inflation and the possibility of a new wave of correction in the stock markets are likely to support demand for gold as a hedge. In addition, gold may continue to find support from consumer demand and demand from central banks. How central banks handle sustained high inflation will be a key driver for institutional and retail demand in 2022, the WGC notes.