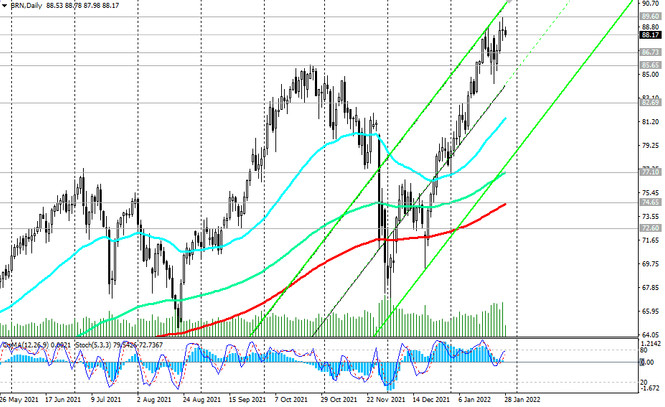

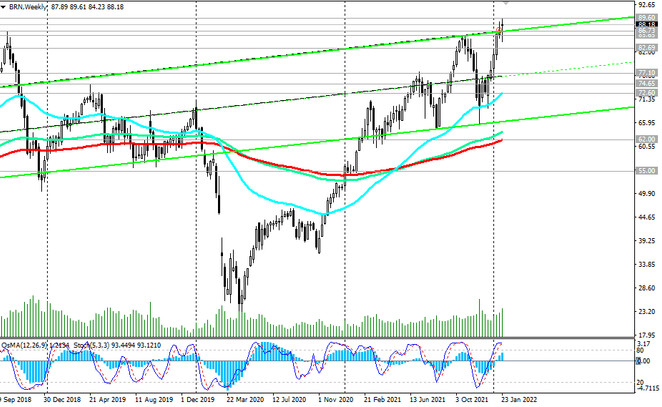

As we noted above, oil prices have risen significantly over the past few weeks, remaining in the bull market and trading above long-term support levels.

At the time of publication of this article, Brent oil futures are traded near the 88.20 mark, remaining in the zone of multi-year highs.

A breakdown of the local resistance level 89.60 will lead to further price growth, despite the fact that oil market analysts predict that the positive dynamics of the oil market will continue against the backdrop of increased demand for energy and limited oil supplies by OPEC+ countries.

In an alternative scenario and in case of breakdown of the local support level 85.65, the price may fall first to the important support level 82.69 (EMA200 on the 4-hour chart), and then to long-term support levels 77.10 (EMA144 on the daily chart), 74.65 (EMA200 on the daily chart) ). Breakdown of the key long-term support level 62.00 (ЕМА200 on the weekly chart) will increase the negative dynamics and the likelihood of a return to the long-term downtrend. The first signal for the implementation of this scenario will be a breakdown of the important short-term support level 86.73 (EMA200 on the 1-hour chart).

Support levels: 86.73, 85.65, 82.69, 77.10, 74.65, 72.60, 62.00

Resistance levels: 89.60, 90.00

Trading recommendations

Brent: Sell Stop 87.55 Stop-Loss 89.65. Take-Profit 87.00, 86.73, 85.65, 82.69, 77.10, 74.65, 72.60, 62.00

Buy Stop 89.65. Stop Loss 87.55. Take Profit 90.00, 91.00, 92.00, 93.00, 95.00, 99.00