Having received support from the continuing growing yields on US government bonds, the dollar was able to stop its decline. On Thursday, the DXY dollar index, reflecting the value of the dollar against a basket of 6 major currencies, rallied, bouncing off the local 20-day low of 93.48, reached during the Asian trading session.

As of this writing, DXY futures are traded near 93.67, 19 pips above the local low of 93.48 hit today. At the same time, the yield on 10-year US bonds rose yesterday to 1.673%, reaching a maximum since May.

Market participants assess the prospects for the Fed's monetary policy, which will remain soft even if, at a meeting on November 2-3, the leaders of the American central bank decide to reduce the volume of purchases on the bond market, which is currently $ 120 billion a month. At the same time, the Fed's interest rates will remain at current levels for at least a few more months. Only half of 18 executives expect interest rate hikes to be required by the end of 2022, and almost all executives anticipate another rate hike in 2023, according to the minutes from the September 21 and 22 Fed meeting released last week.

Thus, despite the expected reduction in the volume of the stimulus program, the Fed's monetary policy remains soft, which is a negative factor for the dollar.

The emerging conditions create preconditions for the growth of American stock indices and the weakness of the dollar. Nevertheless, it is not worth waiting for a deeper decline in the dollar either. It remains a defensive asset amid the continuing rise in the number of people infected with COVID-19, while it remains one of the most demanded currencies in international settlements, having equaled the euro. Thus, 37.6% of client and institutional international payments through SWIFT in October were made in dollars, 0.2% behind the euro (37.8%). Bloomberg reported this in its November 19 article “Dollar Loses to Euro as Payment Currency for First Time in Years”.

In August, Fed Chief Powell said most executives believed the inflationary progress needed to curtail asset purchases had been made, and employment remained a major hurdle. The economy created about 4.9 million jobs through September, which helped restore about half of the lost jobs that were in December. As far as the Fed's employment target is concerned, “I think it's almost achieved”, Powell said.

Thus, the latest data should be enough for the Fed to decide that now is the time to cut the volume of purchases of bonds, which are spent on $ 120 billion a month, although this reduction does not mean that the Fed will soon also start raising interest rates.

Now, market participants will carefully study the incoming macro statistics from the United States, especially regarding inflation and the state of the labor market, ahead of the November meeting of the FRS, in order to more accurately determine its intentions regarding the prospects for monetary policy.

In this regard, market participants will follow the publication (at 12:30 GMT) of weekly data from the US labor market today.

According to the weekly report released last Thursday by the US Department of Labor, the number of initial jobless claims fell to 293,000 from 329,000 a week earlier. Previous values of this indicator: 364 thousand, 351 thousand, 335 thousand. The number of applications remains at the lowest levels since the beginning of the pandemic (the minimum of 293,000 applications was reached in the week of October 1-8). This is a positive factor for the dollar.

The data show a gradual improvement in the US labor market. A report by the Ministry of Labor, published at the beginning of the month, indicated a decrease in the unemployment rate in the country to 4.8% from 5.2% in August. Employers are holding on to employees in conditions of lack of available resources in the labor market, attracting them with higher salaries, which is also an accelerating factor in inflation.

In the week to October 15, initial jobless claims are expected to rise to 300,000 from 293,000 a week earlier, but below the previous weeks until March 20, 2020, when initial jobless claims soared to 3.307 million for the first time from the usual 200 thousand - 300 thousand amid mass layoffs due to the closure of enterprises, when the government began to introduce lockdowns due to the coronavirus pandemic, and the Fed sharply lowered the interest rate to the current level of 0.25%.

Nevertheless, the dollar could fall sharply in the short term if the weekly data from the US labor market turns out to be significantly worse than forecast. Better-than-expected data will help strengthen the dollar.

Also at the same time (at 12:30 GMT) Statistics Canada will publish a report on the country's citizens receiving unemployment benefits, and the ADP will publish an employment report reflecting the change in employment in Canada. The growth of this indicator has a positive effect on consumer spending, which stimulates economic growth.

However, a decrease in the indicator from ADP will have a negative impact on CAD (last month (in August) the number of employed citizens in Canada increased by 39.4 thousand people).

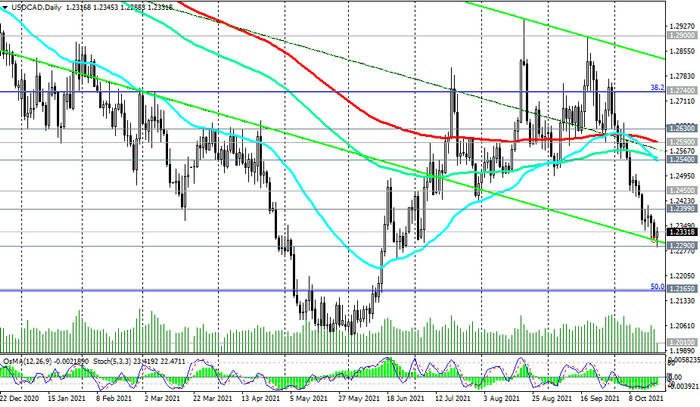

Meanwhile, CAD is strengthening and USD / CAD has been declining for the 5th week in a row. At the time of this article's publication, USD / CAD is traded near the 1.2330 mark, remaining in the bear market zone below the key resistance levels 1.2450, 1.2540, 1.2590, 1.2900 (see Technical Analysis and Trading Recommendations).

The Canadian dollar is also receiving strong support from oil prices, which are still positive and hit 3-year highs today near $ 83.70 for WTI and $ 85.50 for Brent. Canada is the largest exporter of oil, and the share of oil and petroleum products in Canada's exports is approximately 22%.

Despite some uncertainty in the oil market due to the spread of the delta strain of the coronavirus, many leading economists predict further increases in energy prices (coal, gas, oil), including due to expectations of a cold winter and the rush demand in the gas market.

Thus, today at 12:30 (GMT), a sharp increase in volatility is expected in the financial markets and, above all, in the USD / CAD pair. If the official data of the US Department of Labor turns out to be disappointing, then we should expect a further decline in USD / CAD.

In terms of CAD dynamics, it is also worth paying attention to the release (at 12:30 GMT) on Friday of the Retail Sales Index, which is published monthly by Statistics Canada and estimates total retail sales. The index is often considered an indicator of consumer confidence and reflects the health of the retail sector in the near term. A rise in the index is usually positive for the CAD; a decrease in the indicator will negatively affect the CAD. The previous value of the index (for July) was -0.6% (in annual terms) after falling in March 2020 by -9.9%, in April - by -25% and growth in May by +18.7%. If the data for August turns out to be weaker than the forecast (+2.0%) and / or the previous value, then the CAD may sharply decline in the short term.