Despite the continuing rise in oil prices and high gas prices, which support the growing shares of the oil and gas sector, global and major US stock indices declined in the first half of today's trading day.

Last week was the best for the Dow Jones Industrial Average and S&P 500 since July, despite their decline early last week. However, index futures are declining today. Nasdaq100 futures to the moment are down 0.51%, Dow Jones Industrial Average futures are down 0.37%, and S&P 500 futures - 0.4%. The decline in European and US indices comes amid falling Asian stocks after data released at the beginning of the Asian session indicated a sharp slowdown in economic growth in China in the third quarter. According to this data, presented by the National Bureau of Statistics, the GDP of this country in the 3rd quarter grew by 4.9% (in annual terms) against the growth of 7.9% in the 2nd quarter and the forecast of +5.2%. Earlier, the Chinese government took a number of measures aimed at stabilizing the real estate market and the technology sector of the country's economy, which had a negative effect on Asian indices. Now the situation is aggravated by rising energy and electricity prices, as well as problems with logistics supply chains for products, raw materials and components. Market participants are also analyzing the risks to the global economy from protracted inflation and increased demand for energy and electricity.

The above factors increase the uncertainty and volatility of the indices, creating also risks for the global economy. In this regard, the demand for the dollar as a defensive asset is growing again. As of this posting, DXY futures are traded near 94.15, 39 pips above their local lows reached last week.

The positive dynamics of the dollar and the demand for it as a defensive asset remain. Market participants expect that at a meeting on November 2-3, the Fed will announce the beginning of a reduction in purchases on the bond market, which should support the dollar. “Asset purchases have been an important response to the economic impact of the pandemic, but they have already served their purpose”, Fed representative Michelle Bowman said Wednesday. Now, in her opinion, "the possible negative effects of stimulus measures outweigh the potential benefits".

Today, market participants will pay attention to the publication (at 13:15 GMT) of data on industrial production in the US for September. They are supposed to have risen for the seventh straight month (+0.2% after rising +0.4% in August). Strong consumer demand supports this figure despite supply chain problems for components and raw materials. This is a positive factor for US stock indices, although it will be short-term.

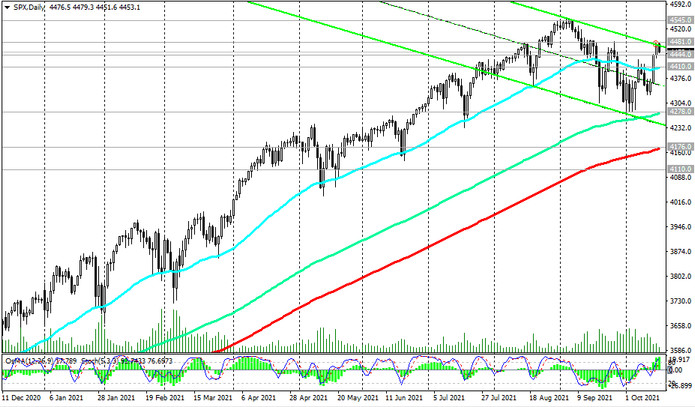

Returning to the dynamics of the American S&P 500 broad market index, it should be noted that it has more than half recovered the losses it suffered in September. Global and US stocks fluctuated strongly last month amid concerns about the possibility of another slowdown in the recovery due to rising cases of new coronavirus infections, as well as fears about the Chinese economy. As you know, the largest developer China Evergrande Group remains on the verge of bankruptcy, and another large Chinese developer Fantasia Group Holdings announced that it could not repay some of its dollar-denominated bonds. Strong selling of shares in some of the largest technology companies also contributed to the decline in equity markets last month.

Market participants will now carefully study the incoming macro statistics from the United States, especially regarding inflation and the state of the labor market, ahead of the November meeting of the FRS, in order to more accurately determine its intentions regarding the prospects for monetary policy.

As of this writing, S&P 500 futures are traded near 4454.0, while maintaining long-term positive momentum. Consideration of the possibility of opening short positions can begin if the S&P 500 falls below 4410.0 (see Technical Analysis and Trading Recommendations). In the meantime, long positions remain preferable, and the breakdown of the local resistance level of 4481.0 will be a signal for their buildup.