Having finished last week with a gain of about 0.5%, the DXY dollar index grows again on Monday, at the beginning of a new week.

As of this writing, DXY futures are traded near 92.76, 16 pips above Friday's close. For today, the publication of important macro statistics in the economic calendar is not planned. Today's Asian trading session passed for the dollar on a positive wave, and in the absence of strong news drivers, most likely, today's trading day will also pass, mainly, with the dollar's advantage over its major competing currencies.

But volatility will rise tomorrow morning, when UK labor market data are released at 06:00 (GMT), and at 12:30. At this time, the US Bureau of Labor Statistics will present a report on consumer inflation in the country, a key factor for the Fed (besides labor market data and GDP) in deciding on monetary policy. The Consumer Price Index (CPI) determines the change in prices of a selected basket of goods and services for a given period and is a key indicator for assessing inflation and changes in consumer preferences. Some slowdown in the growth rate of CPI is expected (+0.4% in August against +0.5% in July). However, the indicator points to continued growth in inflation. Although earlier the leaders of the FRS, including its head Jerome Powell, have repeatedly said that it is more important for them to bring the labor market to pre-pandemic levels, considering the growth of inflation to be a temporary phenomenon, nevertheless, the growth of inflation also cannot but worry them.

The US consumer price index (CPI) rose 5.4% in July, while the core CPI, the Fed's preferred inflation indicator, rose 4.3% in July. This is despite the fact that the target inflation rate of the Fed is at 2%. Current inflation indicators reveal that the target level of inflation is exceeded by more than 2 times.

It is also noteworthy that the data published last Friday indicated an increase in producer selling prices in August by 0.7% (+8.3% in annual terms). The Fed cannot fail to understand that the rise in producer prices will inevitably lead to growth and consumer inflation. Surely, many of the Fed leaders are wondering whether it is time to start preempting a more rapid rise in inflation, which will then be difficult to contain?

The Fed is currently buying $ 120 billion in Treasury bonds and mortgage-backed securities every month and withholding interest the rate near the zero level (0.25%). It is unlikely that one should expect that following the meeting on September 21-22, the Fed leaders will start curtailing the stimulus program. However, they can signal that this process will begin after the Fed meeting on November 2-3.

In addition, the recovery of the labor market in the country is gradually gaining momentum. According to the weekly report of the US Department of Labor, presented last Thursday, the number of initial claims for unemployment benefits for the week of September 3 fell from 345 thousand to 310 thousand, which also turned out to be better than the forecast of 335 thousand. The number of secondary claims for the week of August 27 decreased from 2.805 million to 2.783 million, and the average number of primary applications over the past 4 weeks on September 3 decreased from 356.25 thousand to 339.5 thousand.

Fed officials will continue to wait and see if the Labor Department's September report on US non-farm jobs and unemployment rates turns out to be disappointing: a surge in new coronavirus infections delaying the return of Americans to work.

However, if this report turns out to be as strong as the June and July reports, when the NFP came out with a value of +962 thousand and +1053 thousand, then the Fed leaders will have reason to revise the policy towards tightening it already this year.

It is also necessary to monitor the rhetoric of new statements by the Fed leaders. As it happened before, they are beginning to gradually prepare market participants for the upcoming changes in the Fed's policy in order to avoid sharp movements in the financial markets.

As a matter of fact, Fed Chairman Powell also spoke about this. Earlier, he has repeatedly stated that market participants will be warned in advance that Fed leaders intend to begin cutting the program to stimulate the economy.

At the beginning of tomorrow's trading day (at 01:30 GMT), a block of macro statistics on Australia will also be released, and at 02:45 the head of the RBA Philip Lowe will speak. It is possible that he will touch upon the topic of the central bank's monetary policy. In this case, the volatility of the AUD quotes will increase.

Investors would like to hear from Lowe his views on central bank policy amid the ongoing coronavirus pandemic and Australia's first recession in 30 years. According to Lowe, "there is no serious argument in favor of tightening monetary policy in the short term", and "it will be some time before interest rates rise".

If he does not make unexpected statements regarding the prospects for the RBA's monetary policy, then the reaction of market participants to his speech will be weak.

And on Thursday (01:30 GMT) important data from the Australian labor market will be published.

RBA leaders have repeatedly stated that in addition to the situation in international trade, the Australian economy and monetary policy plans of the central bank are influenced by indicators of the level of debt and expenditures of households, the growth of salaries of workers, as well as the state of the country's labor market. In the opinion of the RBA management, an unemployment rate of 4.5% or lower is required to raise wages and accelerate inflation to the target range.

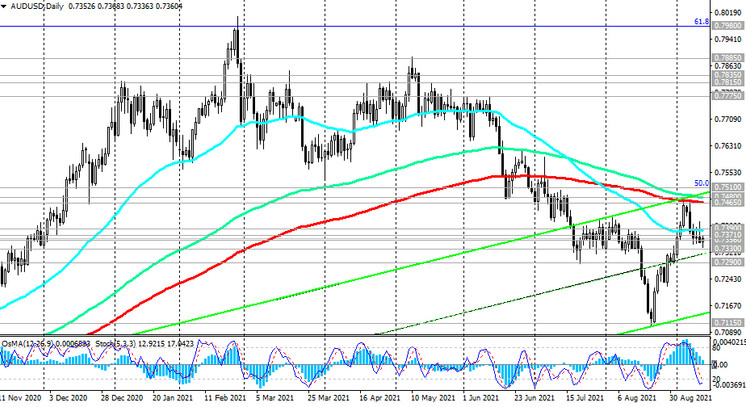

Forecast: unemployment in Australia was at 4.9% in August (against 4.6% in July), and the number of Australian citizens in employment fell by -70,000. Overall, the numbers look disappointing, which is likely to have a negative impact on the AUD. If the values of the indicators turn out to be worse than the forecast, then the Australian dollar may significantly decline in the short term. The data better than the forecast will strengthen the AUD and cause the AUD / USD pair to rise, but only in the short term. In general, the downward trend in AUD / USD remains.