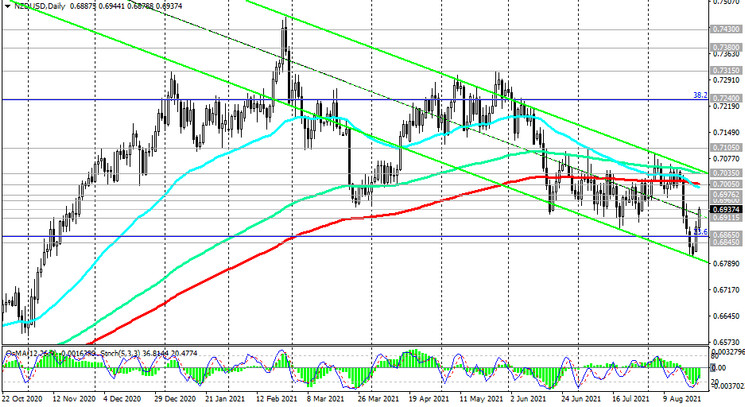

As we noted above, the RBNZ's decision not to raise the interest rate caused a sharp decline in the NZD quotes. At the end of last week, the NZD / USD pair dropped (by 3.2%, to 0.6815 mark), breaking through the key support level 0.7005 (ЕМА200 on the daily chart).

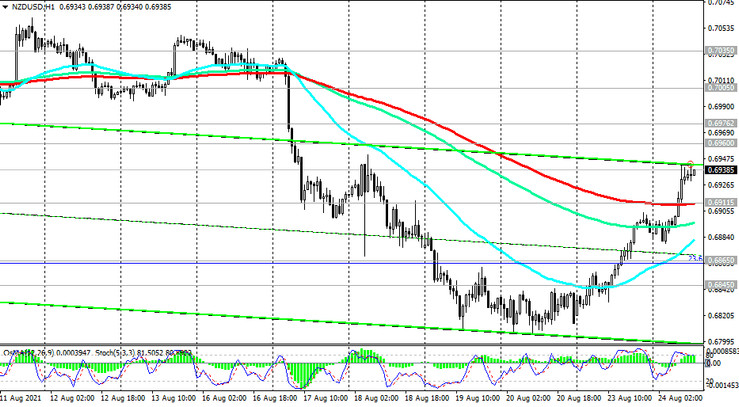

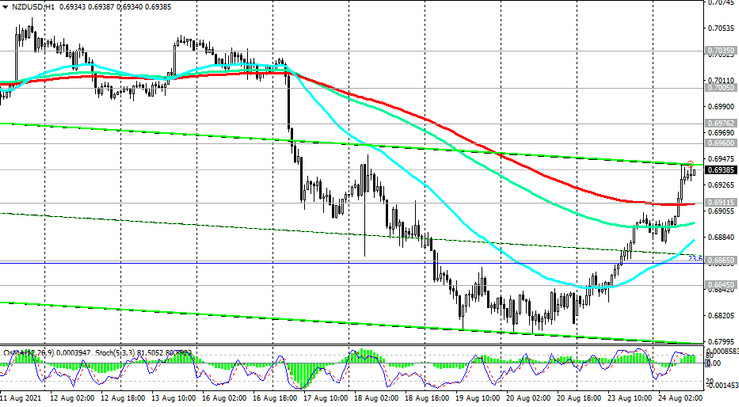

Nevertheless, the pair did not go deeper into the zone below the key long-term support level 0.6845 (ЕМА200 on the weekly chart). Since the beginning of the new week, the NZD has been strengthening, while the NZD / USD is growing again. At the time of this article's publication, this currency pair is traded near 0.6938 mark, receiving support from the weakening US dollar.

The nearest growth targets are resistance levels 0.6976 (ЕМА200 on the 4-hour chart), 0.7005 (ЕМА200 on the daily chart), 0.7035 (ЕМА144 and the upper border of the descending channel on the daily chart).

Their breakdown will cause further growth in NZD / USD towards the local resistance level 0.7105 (July highs), and further - to resistance levels 0.7240 (38.2% Fibonacci retracement in the global wave of the pair's decline from 0.8820 level), 0.7300. More distant growth targets are located at resistance levels 0.7430, 0.7550 (50% Fibonacci level), 0.7600.

In an alternative scenario and after a confirmed breakout of the support levels 0.6865 (Fibonacci level 23.6%), 0.6845 (ЕМА200 on the weekly chart), NZD / USD will go to the support level 0.6700 (the lower line of the descending channel on the weekly chart). Its breakdown could finally push the NZD / USD into a bear market zone and return it into the global downtrend that began in July 2014. The first signal for the implementation of this scenario is a breakout of the short-term support level 0.6911 (ЕМА200 on the 1-hour chart).

Support levels: 0.6911, 0.6865, 0.6845, 0.6700

Resistance levels: 0.6960, 0.6976, 0.7005, 0.7035, 0.7105, 0.7240, 0.7315, 0.7380, 0.7430, 0.7550, 0.7600

Trading recommendations

Sell Stop 0.6895. Stop-Loss 0.6965. Take-Profit 0.6865, 0.6845, 0.6800, 0.6700

Buy by market, Buy Stop 0.6965. Stop-Loss 0.6895. Take-Profit 0.6976, 0.7005, 0.7035, 0.7105, 0.7240, 0.7315, 0.7380, 0.7430, 0.7550, 0.7600