The dollar continues to strengthen offensively in the foreign exchange market, and today at 12:30 (GMT), new arguments may appear in favor of its further growth, if, of course, they do not turn out to be significantly worse than the forecast of economists.

At this time, the US Department of Labor Statistics will publish inflation figures for July. It is expected that the Consumer Price Index (CPI), which determines the change in prices of a selected basket of goods and services for a given period, being a key indicator for assessing inflation and changes in consumer preferences, will be released in July with a value of +0.5% (+2.3% in annual terms). Previous CPI values: +0.9% (+5.4% in annual terms). Despite the relative decline, these are very strong indicators, which will probably once again remind the Fed leaders of the need to finally pay attention to the growing inflation in the country.

On Friday, as you know, the US Department of Labor published a report that significantly exceeded forecasts. Non-farm jobs in the US rose 943,000 in July, while unemployment fell to 5.4% from 5.9% in June. July job growth was the largest since August 2020.

Investors and many economists now believe that strong employment figures, coupled with fast-growing inflation, could force the Fed to raise interest rates faster than anticipated, as well as begin cutting back on its current $ 120 billion monthly asset-buying program.

Earlier, the head of the Fed, Jerome Powell, called the current rise in inflation a temporary phenomenon, and considered creating conditions for the country's labor market to return to pre-coronavirus levels as a more important task for the central bank.

Now the Fed leaders have fewer and fewer arguments to ignore these two key factors, and market participants, it seems, also understand this, especially since more and more often from some representatives of the FRS leadership there are signals about the possibility of starting to roll back stimulus programs this year.

The dollar is also in demand amid the ongoing spread of the coronavirus.

So, according to the latest data, the number of newly detected cases of infection in the United States per day again exceeded 250 thousand people. In other regions of the world, authorities are forced to introduce new quarantine measures after fixing another anti-record for COVID-19 infections.

The DXY dollar continues to rally after strong gains last Friday, returning to July highs of 93.19, which in turn is in line with 4-month-old levels.

Meanwhile, market participants are also watching the dynamics of the pound ahead of the publication (on Thursday at 06:00 GMT) of the preliminary estimate for the UK GDP for the 2nd quarter. GDP is considered to be an indicator of the overall health of the economy. The growing trend in the GDP indicator is considered positive for the national currency. Preliminary forecast for Q2: +4.8% (+22.1% YoY) after falling -1.6% (-6.1% YoY) in Q1 2021. The main factors that can force the Bank of England to keep rates low are weak GDP and labor market growth, as well as low consumer spending.

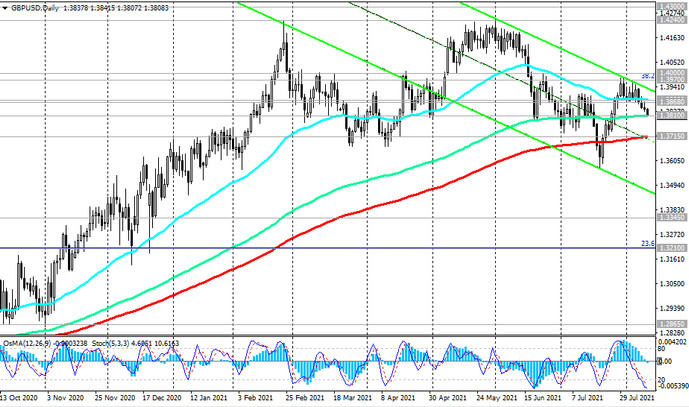

As of this writing, the GBP / USD pair is traded near 1.3810 mark, finding support at the important level expressed by the 144-period moving average on the daily chart.

If the GDP data turns out to be worse than forecast, it will put downward pressure on the pound and on the GBP / USD pair, which remains under the pressure of the strengthening dollar. A strong GDP report will strengthen the pound, but it is difficult to say how strong an upward momentum it can create for the GBP / USD pair. It is nevertheless necessary to take into account the prospects for the dollar, which is gathering more and more supporters in favor of its further strengthening, and the pound, which among the main currencies (except for the dollar) also remains a strong currency.

Last Thursday, the Bank of England left its key interest rate unchanged, but in an accompanying statement indirectly signaled that it could raise rates earlier than expected, although tightening will be moderate and gradual. Wherein, one of the chief executives of the central bank, Michael Saunders, voted to reduce the target volume of purchases of government bonds to 830 billion pounds from 875 billion pounds. In his opinion, maintaining the current pace of purchases is associated with the risk of a more stable excess of the target inflation rate 2%.