At the end of last week, the US dollar strengthened significantly, while the DXY dollar index rose by almost 2% (+170 points), to the mark of 92.20. Despite the fact that the Fed leaders kept key interest rates in the range of 0.00% -0.25%, and the volume of the QE asset purchase program at $ 120 billion per month, market participants were alarmed by some changes in the sentiments of the Fed leaders regarding the timing of the possible start of curtailing the extra soft stimulus policy of the central bank.

The Fed is now forecasting two rate hikes in 2023, while earlier central bank officials had pledged not to raise rates until the end of 2023. 13 of the 18 central bankers said they expect short-term interest rates to rise by the end of 2023, compared with just 7 of them in March. 7 representatives of the FOMC against 4 in March expect the start of rate hikes in 2022.

The accompanying statement said that the Fed will continue to adhere to the current parameters of monetary policy until the target levels for inflation and maximum employment are reached, and the level of interest rates will not change. However, market participants have already got used to these already traditional statements from the Fed, and therefore only a hint of the possibility of an earlier than previously planned start to curtail the Fed's stimulus policy was enough, as the massive closing of short positions on the dollar began, which caused its significant strengthening. At a comparable pace, the DXY dollar index strengthened in early March 2020, before the Fed cut the interest rate to the current level of 0.25%.

At the beginning of a new week, the dollar declines. As of this writing, DXY futures are traded near 92.10 mark, 30 pips below last week's highs corresponding more than 2 months old levels. Also pay attention to the yield on the 10-year US bonds, which today continues to decline for the sixth week in a row.

It seems that large investors are so far ignoring the market noise caused by the results of the Fed meeting, which ended last week, and continue to buy government bonds, nevertheless, insuring against the risks associated with inflation and the possibility of a new wave of the coronavirus pandemic.

The yield on 10-year US government bonds currently stands at 1.428%, below last week's high of 1.595%. The declining yield on government bonds, in turn, creates preconditions for a weakening dollar and an increase in the price of gold, which dropped significantly last week due to the strengthening of the dollar.

Sharp sales of gold last week were triggered by heightened expectations of an earlier than expected possible start to curtail the Fed's stimulus policy. Gold does not generate investment income, and it is extremely sensitive to changes in the interest rates of the Fed and other major central banks in the world.

However, many economists believe that the fall in gold quotes and the decline in the XAU / USD pair last week was excessive.

Assessing the results of the June Fed meeting and the scale of the fall in the price of gold, economists believe that a rate hike on a two-year horizon (now the Fed leaders expect that the interest rate will be raised twice in 2023) is too distant a prospect to ensure such a price decline, especially in backdrop of Treasury bond yields, which are well below the forecasted inflation rate.

While Fed officials have signaled some inclination towards tighter monetary policy, they also said the central bank will continue to buy back $ 120 billion of securities every month, while raising inflation forecasts this year and next.

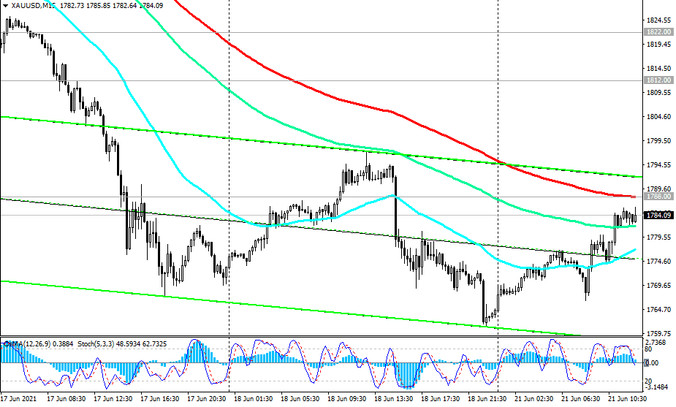

Considering all of the above, our opinion boils down to the fact that gold prices have reached levels from which profitable purchases and growth of the XAU / USD pair are possible. How long this growth will last is a separate question, but in the current situation, short positions on the XAU / USD pair should be closed, and if it grows and consolidates in the zone above the resistance level 1788.00 (see Technical Analysis and Trading Recommendations), you should return to long positions.

This week volatility in the market will be fueled (in addition to the publication of important macro statistics) by the speech of FRS Chairman Jerome Powell in Congress (on Tuesday) and the results of the meeting of the Bank of England (on Thursday). For today, there is no important news in the economic calendar, but it is worth paying attention to the speech of the head of the ECB Christine Lagarde at 12:30 and 14:00 (GMT). Volatility during her speech may increase if she touches on the topic of the Central Bank's monetary policy. If Christine Lagarde does not touch upon the topic of the ECB's monetary policy, then the reaction to her speech will be weak.