In our previous article from 06/04/2021, we assumed "extremely volatile start of the American trading session" (on Friday). And so it happened. Last Thursday, the dollar strengthened sharply after the publication of a block of important macro statistics on the US. The DXY dollar jumped 0.66% on Thursday, gaining 60 points and returning to mid-last month levels (to above 90.50 mark) amid strong US labor market data (from ADP and US Department of Labor on jobless claims) and data from the agency IHS Markit and the ISM Institute, which reported the growth of business activity in the services sector of the American economy.

Nevertheless, the dollar fell again last Friday, despite strong official data from the US Department of Labor for May, published at the beginning of the American trading session.

On Friday, the DXY dollar index lost more than half of Thursday's gains, falling to the 90.13 mark.

US Labor Department data showed that US employers created 559,000 non-farm jobs in May, and unemployment fell to 5.8%.

Economists had expected the number of non-farm jobs to rise by 671,000 in May, with unemployment at 5.9%.

Thus, the number of jobs outside of agriculture in the United States grew slightly weaker than expected by economists, although unemployment fell more than expected. In general, these statistics showed that the labor market is improving, but not at the rate that could force the Fed to soon abandon additional support for the economy. Market participants believed that the continued strong macro data from the US is unlikely to influence the opinion of the Fed leaders, who are inclined to continue the strong stimulating policy of the central bank.

Fed officials remain convinced that rising price pressures will be short-term, suggesting that interest rates will remain unchanged until 2023, as they (Fed officials) promised earlier. For them, more important than rising inflation is the full recovery of the labor market. Despite strong data, the total number of US jobs in May was still below pre-coronavirus levels by about 7.6 million, and 9.3 million potentially ready-to-work Americans remained unemployed. At the same time, the share of the economically active population working or looking for work even slightly decreased in May, to 61.6% against 63.3% in February 2020.

The dollar strengthened slightly during today's calm Asian session, while the DXY dollar index rose slightly, adding 3 points to last Friday's closing price. As of this writing, DXY futures are traded near 90.16, 46 pips below last week's high.

Now market participants will wait for the results of the Fed meeting scheduled for next week. The Fed's monetary policy decision will be released on Wednesday June 16 at 18:00 (GMT).

And this week the general attention of market participants will be riveted on the ECB meeting (and to a lesser extent - on the meeting of the Central Bank of Canada). Its decision on monetary policy will be published on Thursday at 11:45 (GMT).

The European Central Bank is likely to raise inflation forecast for 2021 to 1.7% -1.8% from the current 1.5%, taking into account stronger-than-expected inflation figures for April and May, economists say, also expecting, that the ECB will prefer not to pay attention to the temporary acceleration of inflation, and will also keep the pace of the PEPP program in the 3rd quarter at the average level for the 2nd quarter. Economists also note market expectations for the first rate hike by the ECB in mid-2023, although this, in their opinion, is still too early.

Following the meeting on Thursday, it is likely that the key interest rate of the ECB will remain at the same level of 0%. The ECB's rate on deposits for commercial banks is also likely to remain at -0.5%, and ECB President Christine Lagarde will signal the continuation of a soft course, rejecting assumptions about its curtailment. According to economists, the Central Bank will also continue to buy government bonds at about 80 billion euros per month, accompanying this decision with a statement on the continuation of stimulation.

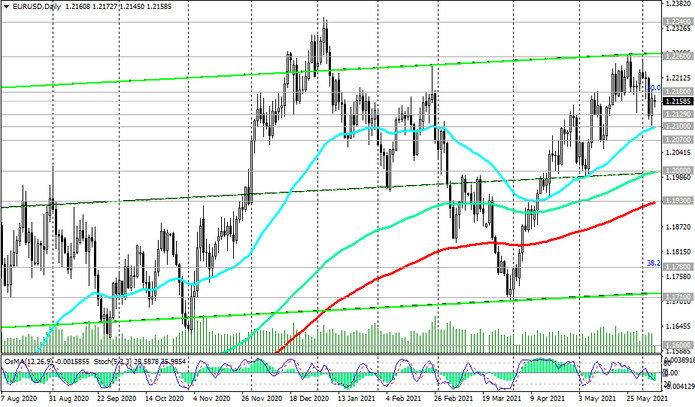

Thus, the ECB, most likely, will not surprise market participants. At the same time, amid expectations of further weakening of the dollar, at least until the end of this year, the EUR / USD pair is likely to resume growth. At the time of this article's publication, it is traded near the 1.2160 mark. A breakdown of the nearest resistance level 1.2180 may be the first signal for the resumption of long positions, while a breakdown of the local resistance level 1.2260 will confirm a scenario for further growth of EUR / USD (see Technical Analysis and Trading Recommendations).