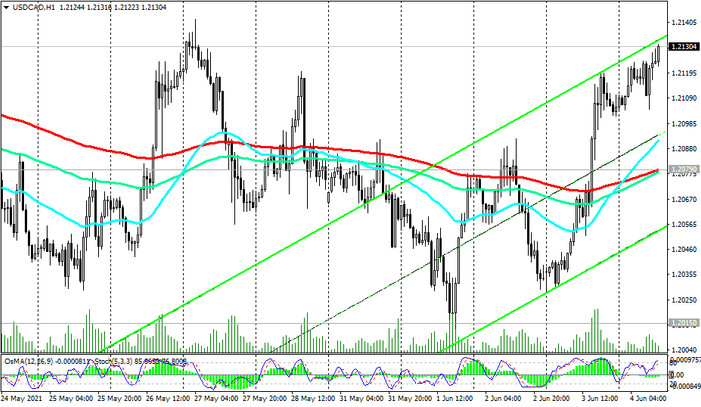

At the beginning of today's American session, the USD / CAD pair is traded near the 1.2130 mark, in the zone above the important short-term level 1.2079 (ЕМА200 on the 1-hour chart), which was broken yesterday against the background of strengthening USD after the publication of strong US macro data.

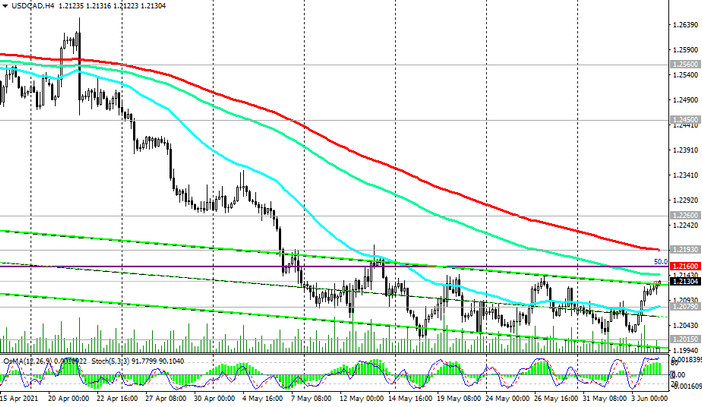

Nevertheless, being in the zone below the important long-term resistance levels 1.2450 (ЕМА200 on the monthly chart), 1.2985 (ЕМА200 on the weekly chart), 1.2690 (ЕМА200 on the daily chart), USD / CAD remains inclined to further decline amid strong fundamental factors actually being in the bear market zone.

A breakdown of the support level 1.2079 will be a signal for the resumption of short positions.

In an alternative scenario, a confirmation signal of the beginning of a reversal and breaking of the bearish trend will be a breakdown of the resistance level 1.2160 (Fibonacci level 50% of the downward correction in the wave of USD / CAD growth from 0.9700 to 1.4600) and short-term resistance level 1.2193 (ЕМА200 on a 4-hour chart) with the prospect of growth to resistance levels 1.2450, 1.2690.

Support levels: 1.2100, 1.2015

Resistance levels: 1.2160, 1.2193, 1.2260, 1.2450, 1.2560, 1.2690, 1.2740, 1.2985

Trading scenarios

Sell Stop 1.2090. Stop-Loss 1.2150. Take-Profit 1.2000, 1.1900

Buy Stop 1.2150. Stop-Loss 1.2090. Take-Profit 1.2160, 1.2193, 1.2260, 1.2450, 1.2560, 1.2690, 1.2740, 1.2985