At the beginning of the new week, futures for US stock indices are increasing, while the dollar is decreasing. As of this writing, DXY dollar futures are traded near 89.97 mark, 3 points below Friday's close.

The dollar index is declining, mainly due to the strengthening against the dollar, the euro, whose share in the DXY index is more than 50%.

Today, in a number of European countries and in Catholic countries, the Day of the Holy Spirit is celebrated. Therefore, banks and stock exchanges do not work in them. It is likely that amid low trading volumes, the dollar will retain its downward bias, while futures on US stock indices will continue to grow.

S&P 500 futures added 0.3% to last week's close, while Dow Jones Industrial Average futures added 0.4%.

As of this posting, S&P 500 futures are traded near 4175.0 mark, 15 points above last week's close that was negative for the S&P 500.

Investor sentiment is improving amid successful coronavirus vaccinations and a gradual recovery from lockdowns in Europe and the United States.

At the same time, the world's major central banks tend to continue to pursue their super soft policies. The main attention in this respect, of course, is given to the position of the FRS leadership in this matter. And last week it confirmed its intention to keep the interest rate near zero until the end of 2023.

The decision to continue buying at least $ 120 billion a month in Treasury bonds and mortgage-backed securities and to keep interest rates near zero was taken unanimously by Fed leaders in April.

The minutes of the US Federal Reserve Open Market Committee (FOMC) published last Wednesday confirmed these plans of the FRS leadership, although they gave food for thought to market participants. According to the minutes, some central bank leaders consider it advisable to discuss the issue of curtailing stimulus in the event of further rapid economic recovery.

Some of the Fed leaders want to start discussing a plan to reduce the large-scale bond buying program at the next meeting, i.e. in mid-June.

And yet, many economists believe that despite strong inflation in the US, some important macro data, in particular the labor market, remain weak, and, in their opinion, it will take several stronger months before the Fed begins discussions the issue of tightening the policy.

“In my opinion, judging by the April labor market report, we have not made further significant progress”, said Fed Deputy Chairman Richard Clarida last week. “We are seeing a very volatile period”, he added.

"Several participants in the meeting indicated that if the economy continues to make rapid progress towards the goals of the committee, at some stage it may be advisable to start discussing a plan to adjust the pace of asset purchases during the upcoming meetings", the minutes said.

But they also say that many Fed leaders expressed similar views with Fed Chairman Jerome Powell that the Fed should warn the markets in advance that it will begin to cut purchases.

“I think if we tried to stay ahead of the inflation curve now, we could end up limiting the pace of recovery significantly”, one of the Fed chiefs Randal Quarles said in a speech before Congress on Wednesday.

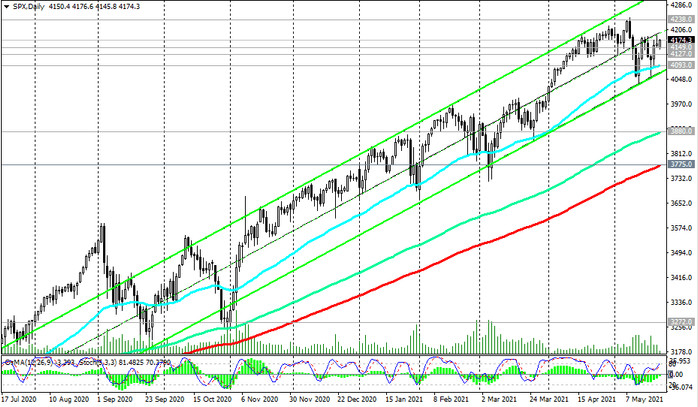

Thus, so far, a favorable environment is emerging for the further growth of stock indices. From a technical point of view, major US stock indices, including the S&P 500, also continue to remain in the bull market zone (see Technical Analysis and Trading Recommendations), making long positions preferable.