The yield on US government bonds continues to decline after the 10-year bonds reached a multi-month high of 1.776% at the end of March.

The dollar is also weakening and the DXY dollar index is declining.

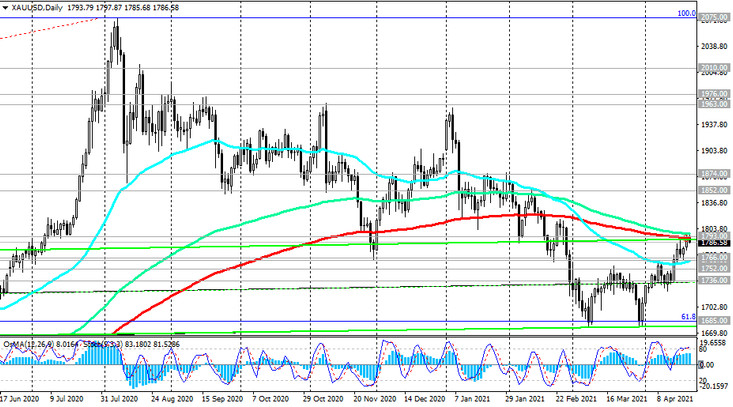

In this regard, and against the background of the fact that the need for protective assets still persists, investors again turned their attention to gold. The demand for it is growing, and the XAU / USD pair reached an 8-week high near 1797.00 yesterday and today during the Asian session.

The world situation with coronavirus remains tense, while the number of cases of COVID-19 is growing in Asia, Europe and even in the United States, despite outstripping vaccination rates in this country. Earlier, US President Joe Biden promised that the entire US population will be vaccinated by the end of July.

At the same time, the weakening dollar, which reacts less and less positively to strong macro data coming from the US, creates preconditions for further growth of the XAU / USD pair.

Today at 12:30 (GMT) weekly data from the US labor market will be published. The number of initial jobless claims is expected to rise again, by 617,000, after rising by 576,000 in the previous weekly reporting period. The data shows that the American labor market is still far from full recovery. The FRS, most likely, will not start tightening its monetary policy anytime soon. As follows from the recently published minutes from the March meeting, Fed leaders tend to maintain the current level of interest rates of 0.25% until the end of 2023. They also again expressed no desire to change the parameters of the asset purchase program, which amounts to $ 120 billion per month.

According to the data published earlier, consumer inflation in the US rose to 0.6% in March (against the forecast of 0.5% and 0.4% in February). Annual inflation in the US in March amounted to 2.6% against 1.7% in February, which exceeded the forecast of 2.5%.

Nevertheless, the leaders of the American central bank adhere to a wait-and-see attitude, allowing inflation to rise and considering it a temporary phenomenon. They expect inflation to rise for several months and then decline.

Today, volatility in financial markets, including in the quotes of the XAU / USD pair, may also rise sharply at 11:45 (GMT), when the ECB's decision on rates is published, and the ECB's press conference will begin at 12:30.

ECB leaders will assess the current economic situation in the Eurozone and comment on the rate decision. If they make unexpected statements, volatility will skyrocket. However, most likely, the ECB leaders will prefer to take a wait and see attitude.