According to data published on Tuesday, consumer inflation in the US rose to 0.6% in March (against the forecast of 0.5% and 0.4% in February). Annual inflation in the US in March amounted to 2.6% against 1.7% in February, which exceeded the forecast of 2.5%.

This index (CPI) is a key indicator for assessing inflation and changes in purchasing preferences, as well as one of the determining factors (along with GDP and labor market data) for the Fed in determining the prospects for its monetary policy. Data released on Tuesday renewed highs since 2012, indicating faster consumer price increases and heightening talk about the timing of the Fed's monetary policy adjustment. The leaders of the American central bank adhere to a wait-and-see attitude, allowing inflation to rise and considering it a temporary phenomenon. In their opinion, the high rates of inflation reflect the high rates of recovery of economic activity in the country.

Fed officials expect inflation to rise over the next few months and then decline. Therefore, despite the acceleration of inflation in the US that exceeded expectations, the dollar reacted on Tuesday with a fall to the publication of inflation indicators, having lost support from US government bonds, the yield of which decreased.

The DXY index fell yesterday to a 3-week low of 91.85, and today it is declining again, reaching 91.65 during the Asian session.

Investors most likely believed that higher-than-expected inflation in the US in March would not be enough reason for the Fed to abandon loose monetary policy. The minutes of the March meeting released last week confirmed that Fed officials are inclined to continue to support the economy by maintaining ultra-low interest rates and making large monthly bond purchases. During the meeting, held March 16-17, they said they still expect interest rates to remain near zero until the end of 2023, and did not express their readiness to curtail the bond purchase program.

At a press conference after the March meeting, Fed Chief Powell said that "the economic recovery is uneven and far from complete, and the path that remains to be taken remains uncertain", noting that current "monetary policy will continue to provide strong support to the economy until its recovery is complete".

Today at 16:00 (GMT) Jerome Powell will make another speech, and, for sure, will touch upon the acceleration of inflation in the US and the prospects for monetary policy. Most likely, the rhetoric of his statements will remain the same. Powell will likely try to calm the markets again, assuring that the Fed will not change the parameters of the current monetary policy until at least the end of 2023. Earlier Powell promised that the Fed would give early warning about the possible timing of the start of the rollback of bond purchases, which now amount to $ 120 billion a month. The market's reaction to his speech is likely to be calm.

Nevertheless, market participants will closely follow the course of his speech, since possible unexpected statements on his part may force investors to make adjustments to their trading plans, causing a surge in volatility in the entire financial market.

But, most likely, today Powell will reaffirm the commitment of the Fed leadership to continue the current policy.

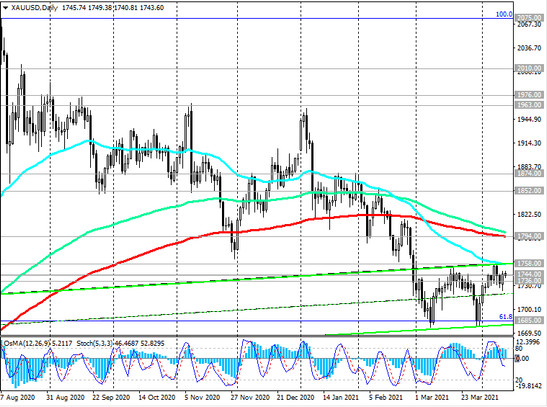

Meanwhile, gold yesterday rose in price, and the XAU / USD pair broke through two important resistance levels 1736.00, 1744.00 (see "Technical Analysis and Trading Recommendations").

The Fed's printing Press, gaining momentum, a new $ 1.9 trillion government stimulus plan that became law on March 11, and the Fed's loose monetary policy are driving inflation and dollar devaluation. Investors are forced to look for additional ways to hedge the risks associated with rising inflation. One of the tools for this is gold. If it were not for the growing yields on US government bonds, then gold purchases would probably have been of a larger scale.

In addition to Powell's speech at 16:00 (GMT), investors will also pay attention to the speech by US Treasury Secretary Janet Yellen (at 18:15) and the publication (at 18:00) of the Fed's monthly economic review, known as the "Beige Book".