Last week, gold quotes rose. Gold futures hit their highest closing price in three weeks on Friday as US Treasury yields fell after a jump in the previous session.

Gold is supported by fears about inflation and nervousness caused by falling stock indices. Despite the rise in government bond yields, gold is still in demand as a hedge against inflationary risks. The $ 1.9 trillion fiscal stimulus, along with loose Fed policy, is likely to support US economic growth this year. The US economic recovery is gaining momentum, and Americans' spending is on the rise, especially on services that were previously restricted due to coronavirus quarantines.

But these factors also provoke a rise in inflationary expectations on the part of investors.

At last week's meeting, Fed officials left rates and the $ 120 billion a week asset purchase program unchanged. They also released forecasts that rates will not change until the end of 2023, despite the expected rise in inflation. Investors will focus on Friday's US inflation data. Inflation is likely to rise in the coming months as a result of strong consumer demand, supported by direct payments as part of the stimulus package. Nevertheless, the Fed still believes that the rise in inflation will be temporary.

Powell pledged not to raise interest rates until inflation stabilizes at the Fed's target and full employment is achieved.

Most Fed officials predict that this means rates will remain near zero for at least three more years.

At the same time, investors are asking themselves: what if the inflation target is reached earlier? If inflation rises quickly, for example, to 3%, would the Fed want to raise rates earlier?

Leading US stock indices were volatile last week, ending it lower. On the one hand, the economic outlook is improving, on the other, investors fear that interest rates will rise faster than expected.

Today, American investors await a speech by US Federal Reserve Chairman Jerome Powell (at 13:00 GMT), as well as FRS representatives Mary Daily and Randall Quarles (at 14:00 and 14:30 GMT).

Jerome Powell and US Treasury Secretary Janet Yellen will speak to members of the Senate Banking Committee on Wednesday and Thursday. Investors will be interested to hear their views on the prospects for monetary policy. Also this week is expected data on home sales, orders for durable goods and consumer spending in the United States.

And yet, a long period of low rates, as well as significant injections of funds into the global economy, will contribute to a noticeable increase in inflation, which will support gold quotes.

The demand for defensive assets, which, in particular, is gold, may also grow again against the background of growing geopolitical risks, since the US presidential administration continues its aggressive policy towards China and Russia.

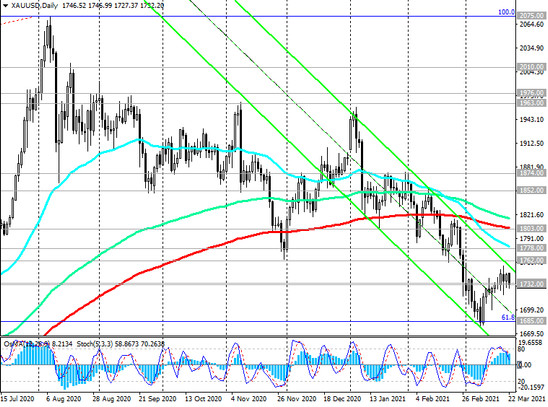

Thus, the current decline in gold prices can be viewed as an opportunity to buy gold futures, despite the continuing rise in US government bond yields and the strengthening of the dollar.

By the way, today the yield on 10-year US bonds is declining after last week it reached a local multi-month high of 1.754%. Following the decline in bond yields, the dollar is also weakening.

According to economists, there is now a confrontation in the market between an increase in government bond yields, which puts downward pressure on the price of gold, and an increase in inflation expectations and nervousness in the stock markets, which supports gold, which is thus between a kind of hammer and anvil.