Last Wednesday after the International Energy Agency (IEA) presented a report in which it raised its forecast for growth in global oil demand in 2021 by 100,000 barrels per day to 5.5 million barrels per day. Meanwhile, the IEA noted that the global consumption of gasoline has already formed a peak, and the reduction in demand in developed countries will be more important and more significant than the growth in demand in developing countries. According to the IEA, the world's oil reserves are still higher than a year ago, at the beginning of the pandemic that hit demand. By the end of January, OECD stocks were 110 million barrels higher than the year before the pandemic began, according to the IEA.

Despite long-term and large-scale OPEC+ production cuts and forecasts of production declines in several other countries, "oil reserves (in storage) look high compared to historical levels", the IEA said in a report.

The day before, oil quotes were under pressure from media reports about the suspension of the use of the AstraZeneca vaccine in some European states. Even if the credibility of AstraZeneca can be restored, vaccination problems will continue as the number of new strains of the virus grows, economists say. This rate of vaccination casts doubt on the rapid recovery of the European economy and oil demand.

Oil prices declined on Tuesday, and continued to decline on Wednesday after the IEA report and the publication of data from the US Department of Energy. According to a report by the Energy Information Administration (EIA) of the US Department of Energy, oil reserves in the country in the week of March 6-12 rose by another 2.396 million barrels after rising by 13.798 million barrels a week earlier, and now they are 6% higher than the average five-year level for this time of year.

The strengthening of the dollar after the Fed meeting on Wednesday

and the fall in stock indices also left a negative imprint on the oil market, and as a result, oil prices fell sharply on Thursday, showing a decline in the 5th session in a row and dropping to a closing minimum of more than 14 days.

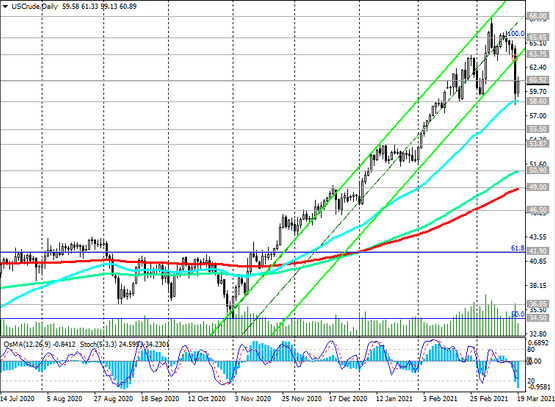

Last Thursday, the price of WTI crude oil reached $ 58.23 per barrel, the lowest in the last 5 weeks.

Despite this, positive price dynamics remain above the support level 58.60, and a rise into the zone above $ 61.00 per barrel will confirm the recovery of the bullish trend (see "Technical analysis and trading recommendations"). Despite the current decline, since the beginning of the year, oil quotations have grown by 30%.

Today, oil market participants will, as usual, follow the publication (at 17:00 GMT) of the weekly data of the oilfield services company Baker Hughes on the number of active drilling rigs in the United States. After their number reached 888 in November 2019, the number of active drilling rigs in the United States subsequently began to decline, and in March 2020, the pace of closure of oil rigs accelerated significantly due to a sharp decline in oil prices.

On the week before last, their number was 402 (against 403, 309, 305, 306, 299, 295, 287, 275 in the previous reporting periods). It is obvious that the number of oil companies in the US is growing again, which is a negative factor for oil prices. Another rise is likely to have a negative impact on oil quotes, but, most likely, only in the short term.

In fact, the dynamics of the oil market at the moment will be determined by the dynamics of the dollar and stock indices, the volume of production and oil reserves in the world, as well as information regarding the situation with the coronavirus.