The GBP / USD has declined in the last 4 trading days, helped by the strengthening of the dollar during this time period. Fed Chairman Jerome Powell, speaking last week, tried to calm the markets by reassuring that the central bank monetary policy would remain soft. Powell's comments, who noted that it may take about three years for the economy to achieve the main targets of the US Federal Reserve, and all this time the regulator will maintain a soft monetary policy, put pressure on the US dollar.

Nevertheless, receiving support from the growing yields of US government bonds, which also restrains growth in the stock market, the dollar is strengthening, and the DXY dollar index is growing today for the 6th day in a row.

US government bonds are one of the most reliable assets that generate investment income. And the growth of their profitability may force investors to soon think about buying them, preferring them versus risky stocks, which will put pressure on the stock market and also support the dollar.

As of this writing, DXY futures are traded near 91.30, 162 points above their local lows reached last week.

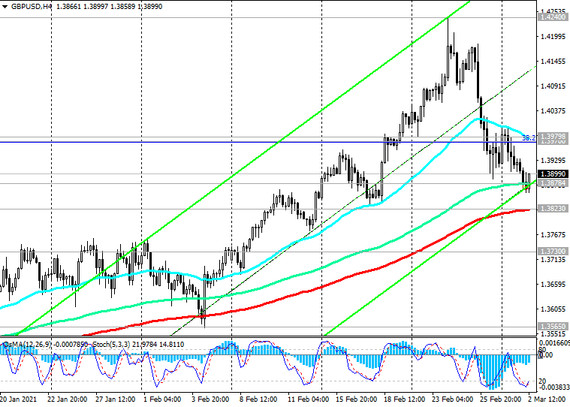

At the same time, the GBP / USD pair has reached the zone of strong support levels 1.3878, 1.3823 by now (see Technical Analysis and Trading Recommendations).

From a technical point of view, and while maintaining the positive dynamics of the pair, it would be a good idea to place buy orders on GBP / USD in this area.

Expectations of an early recovery in the global economy amid massive fiscal stimulus in the United States and the launch of the vaccination campaign continue to support investor optimism, which negatively affects the US dollar as a safe haven asset.

At the same time, the room for a further fall in the pound is likely to be limited, given the optimism about the recovery of the UK economy amid the rapid pace of vaccinations in the country.

Recent evidence shows that vaccines are effective in reducing hospital admissions and mortality rates. This raises hopes that mass vaccinations can reduce the need for restrictive measures and pave the way for the economy to resume.

Markit's UK manufacturing PMI (for February), released on Monday, rose from 54.9 to 55.1, which was also better than the forecast of 54.9.

At the same time, the index of mortgage approvals, reflecting the number of approved mortgage loans, rose by 99,000 in January (against the forecast of +96,000). This indicator is a leading indicator of the UK housing market and speaks of its healthy state stimulating overall economic growth. The high value is positive for the GBP.

The Nationwide house price index released today, showing the price dynamics in the UK real estate sector, also indicated a rise in prices (+6.9% in February on an annualized basis, versus +6.4% a month earlier), which is a positive factor for the GBP, since indicates a steady state of the British economy and rising inflationary pressures. And this, in turn, may force the Bank of England to soon return to the issue of raising the interest rate to curb inflation, which will also have a positive effect on the pound quotes.