On Tuesday, Jerome Powell again tried to calm the markets and investors, reiterating the Fed's inclination towards soft policy. "The economy is still far from meeting employment and inflation targets", Powell said in a speech to members of the Senate Banking Committee.

The chairman of the US Federal Reserve has reaffirmed the central bank's intention to continue to pursue loose monetary policy until the economy recovers from the effects of the pandemic.

Powell also made it clear that an increase in interest rates will not happen soon, and with regard to growing yields on government bonds, he said that this is a normal reaction of investors who believe in the economic stability of the United States.

However, many economists point out that the growing yields on US government bonds increase the attractiveness of government bonds in comparison with shares, which may create difficulties for their further growth.

The dollar fell after Powell's speech, however, remained in positive territory at the end of yesterday's trading day.

Today, the DXY dollar index declined slightly (by 9 points), and the yield on US 10-year government bonds resumed growth after yesterday's fall, supporting the dollar.

At the time of publication of this article, it was 1.362% against 1.343% at the close of yesterday's trading day.

Powell will deliver the Fed's semi-annual monetary policy report Wednesday to the House of Representatives Financial Services Committee. His speech will begin at 15:00 (GMT). Everything that investors wanted to hear from Powell, he said on Tuesday. It is unlikely that his speech today will greatly affect the market if he does not say something unexpected about the Fed's monetary policy.

Meanwhile, Powell may also call on Congress again for approval of the $ 1.9 trillion stimulus bill. Many economists note that this aid package is too expensive for the US budget, fearing that it could provoke a surge in inflation and an even stronger surge in stock indices, which are already largely overvalued. This, in turn, could force the Fed to start drastically scaling back its stimulus program while simultaneously raising the interest rate, which, in theory, should also lead to a reversal of the dollar's bearish trend.

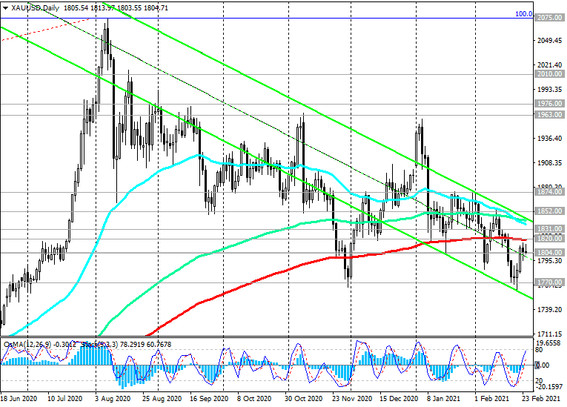

Meanwhile, the growing yield on US government bonds puts pressure on gold quotes.

In theory, additional fiscal stimulus measures will lead to an increase in the debt burden with a possible increase in inflation in the future, which should benefit gold quotes, given the Fed's tendency to maintain a soft monetary policy. However, we may soon see the opposite, negative for gold, effect of the new stimulus plan, because stimulus measures will help keep treasury yields high. And this will continue to put pressure on gold as a defensive asset that does not generate investment income.

At the beginning of today's European session, the XAU / USD pair is traded near the 1804.00 mark, through which an important short-term support level passes (see Technical Analysis and Trading Recommendations). Its breakdown will cause a further decline in XAU / USD. The dollar will probably receive some support today if Powell does not change anything in the rhetoric of his speech, and this will also negatively affect the XAU / USD pair.