Last Wednesday, the Energy Information Administration (EIA) of the US Department of Energy announced a sharp drop in commercial oil reserves in the US. According to the ministry, US oil reserves in the reporting week (January 30 - February 5) decreased by 6.6 million barrels to 469 million barrels. Their volume is now only 2% higher than the 5-year average for the same periods of previous years. The department also reported an increase in oil production in the United States by 100,000 barrels per day, up to 11 million barrels per day. However, this part of the report of the US Department of Energy, the participants of the oil market ignored, focusing on the fall in inventories. As a result, on Wednesday, WTI crude oil futures on the NYMEX rose for the eighth session in a row, demonstrating the longest period of growth in more than two years.

The growth of oil prices last Wednesday was also helped by the weakening of the dollar. On Wednesday, the DXY dollar index declined for the 4th trading day in a row.

Nevertheless, oil prices fell on Thursday and during the Asian trading session on Friday.

The euphoria of oil market participants was partially offset by reports from the International Energy Agency and OPEC. These agencies have revised downward their forecasts for global oil demand in 2021.

Thus, the new forecast of the International Energy Agency (IEA) foresees a drop in global oil demand in 2021 by 200,000 barrels per day.

The global economic recovery and oil demand are still constrained by the coronavirus pandemic, which is forcing schools and companies to close, and air travel in major countries such as the United States is only one-third of normal.

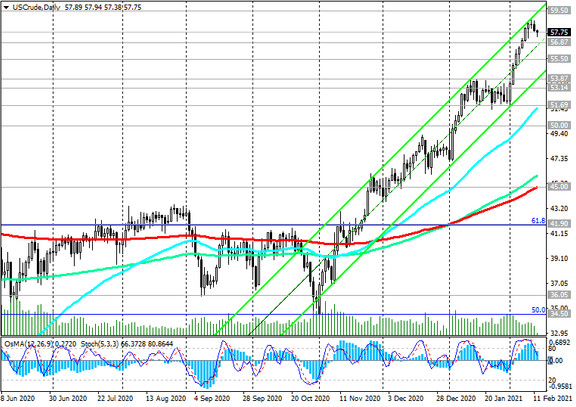

Since the beginning of 2021, oil prices have increased, while WTI and Brent brands have added 11.8% and almost 11%, respectively, in price during this time. This growth came amid optimism in the commodity and equity markets regarding vaccinations and expectations for a new stimulus package in the US.

At the same time, OPEC+ generally complies in good faith with the established production limits, and in addition, Saudi Arabia unilaterally reduced production in February and March by 1 million barrels per day.

Meanwhile, the dollar index stopped falling and is growing on Friday. At the time of this posting, DXY dollar futures are traded near 90.59, in the upper half of the range formed between local nearly 3-year lows near 89.16 and a local high of 91.60 reached at the end of last week.

Last Wednesday, Fed Chairman Jerome Powell signaled that monetary stimulus would continue for a long time and hinted that monetary policy could be even softer than investors expect. According to him, the Fed in the near future is unlikely to "even begin to think about curtailing support" by raising rates or reducing bond purchases. Powell also reiterated his call on the US government to further expand fiscal support for the economy.

The US dollar is likely to weaken in 2021 amid the Fed's loose monetary policy, but stronger US economic growth compared to growth in other countries will be a factor that will limit the decline in the US currency. Until the Fed signals a curtailment of asset purchases and an increase in interest rates, it is hardly worth expecting a significant rise in the dollar.

However, many economists believe that inflation in the United States will accelerate in the coming months, and by May it could reach 4%. In their opinion, the beginnings of a recovery in healthy economic growth and persistently high inflation rates could push Fed leaders to start rolling back quantitative easing before the end of this year and to raise interest rates in 2023. And this suggests that the cycle of large-scale weakening of the dollar is still coming to an end. In turn, a strengthening dollar will put pressure on commodity markets, including oil prices, which are known to be quoted in USD.

Today, as usual, oil market participants will follow the publication (at 18:00 GMT) of the weekly data of the oilfield services company Baker Hughes on the number of active rigs in the United States. After their number reached 888 in November 2019, the number of active rigs in the United States subsequently began to decline, and in March 2020, the pace of closure of oil rigs accelerated significantly due to a sharp drop in oil prices.

On the week before last, their number was 299 (versus 289, 287, 275, 267, 264 in the previous reporting periods). It is obvious that the number of oil companies in the US is growing again, which is a negative factor for oil prices. Another rise is likely to have a negative impact on oil quotes, but, most likely, only in the short term.

In fact, the dynamics of the oil market at the moment will be determined by the dynamics of the dollar and stock indices, the volume of oil production in the world, as well as information regarding the situation with the coronavirus.

At the time of publication of this article, WTI crude was traded near 57.74, down $ 1.14 from the local high of $ 58.88 a barrel reached last Wednesday. And so far, the trend in oil prices has a stable bullish character.