On the eve of the FRS meeting, the dollar seems not going to give up. During today's Asian session, the dollar continued to strengthen. At the beginning of today's European session, futures on the DXY dollar index are traded, albeit slightly, but with an increase (by 6 points) to the opening price of today's trading day, which is 138 points higher than the local almost 3-year minimum reached in early January near 89.16 mark.

The first Fed meeting this year begins today. Market participants expect the Fed to clarify the situation regarding its future plans for this year. They also want to understand the near-term outlook for monetary policy and the dollar, which has lost about 6% in value over the past year due to aggressive stimulus from the US government and the Fed, which has made massive injections of printed and unsecured dollars into the US economy.

Despite this, many economists believe that the dollar is still significantly overvalued. Given the Fed's position that believes it will be able to keep interest rates low for several more years even if inflation is slightly above the 2% target, economists expect further weakening of the dollar, which could lose at least another 20% this year. In addition, the new Democratic government that has come to power in the United States is planning additional fiscal stimulus and a new aid package on top of the trillions of dollars in programs already adopted. This will certainly lead to an increase in the budget deficit and inflation, which will naturally weaken the dollar in the long run.

At the same time, it is critically important for the new government to stop the sharp increase in the national debt. Otherwise, the dollar will sooner or later depreciate, Washington will not be able to service its obligations and the American financial system is threatened, if not collapse, then a severe crisis.

But preventing this process will not be easy. Interest rates are already at historic lows and federal debt is higher than ever since World War II.

The new head of the US Treasury and ex-head of the Federal Reserve System Janet Yellen is committed to a weak dollar policy. She recently pledged that "the United States is not looking for a weaker currency in order to gain a competitive advantage, and we must resist attempts by other countries to do so". However, she has already called on the US government to inject massive liquidity into the economy. This is a signal for a long-term downtrend in the dollar.

The dollar will also weaken if a successful coronavirus vaccine helps revive the economy and trade, economists say.

In short, objectively, the dollar is waiting for further weakening, and the Fed leaders are likely to try to dispel the last doubts of investors in this. Recall that the publication of the Fed's rate decision is scheduled for Wednesday (19:00 GMT). Immediately, the Fed's press conference will begin. Any hints from Jerome Powell about the need to adhere to the current extra-soft and stimulating monetary policy will be perceived by the market as a signal for the dollar to sell along the entire front.

His post-meeting comments may also signal a possible timeline for the completion of incentive measures. This may, if not support the dollar, then at least slow down its decline.

The dollar may also receive support if the epidemiological situation in the world worsens due to the coronavirus and if vaccines are not as effective as expected, as well as if there are hotbeds of international tension in which the United States may be drawn.

From the news for tomorrow, it is also worth paying attention to the publication at the very beginning of the Asian session (at 00:30 GMT) of the consumer inflation indices for Australia for the 4th quarter of 2020.

According to the forecast, the value of the consumer price index (CPI) for the 4th quarter of 2020 is expected to be +0.4% (+0.7% in annual terms against +1.6% in the previous quarter). The expected value of the indicator is positive, but it is likely to provide the Australian dollar with only short-term support, as it is lower than the previous value. If the value of the indicator turns out to be worse than forecast, it will most likely put pressure on the AUD.

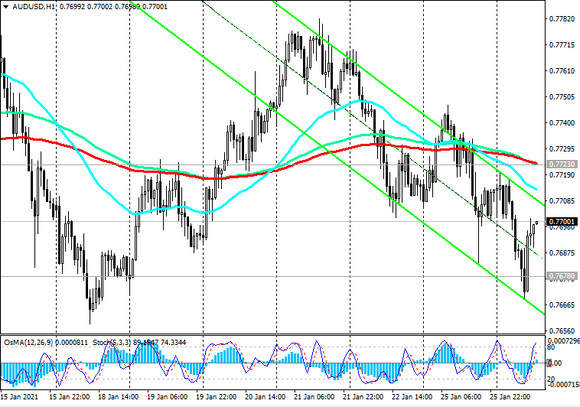

At the beginning of today's European session, the AUD / USD pair is traded in the area of important short-term support levels 0.7639 and resistance 0.7723 (see "Technical Analysis and Trading Recommendations"). Exit from this range may predetermine the direction of further dynamics of AUD / USD.